Dec | 2023

M-PESA Foundation To Construct KES 47 Million Maternal And Newborn Unit In Kiambu County

M-PESA Foundation has today announced a KES 47 million investment to support the construction of a new maternal and newborn unit at Kigumo Level 4 hospital in Kiambu County. The new maternity unit is set to benefit thousands of residents in the county by significantly boosting the hospital's capacity to accommodate expectant mothers and enable the facility to offer enhanced services to more women and children.

Nov | 2023

Safaricom, M-PESA Africa and Sumitomo Corporation to launch an Accelerator Program for Startups

Safaricom has entered into a partnership with M-PESA Africa and Sumitomo Corporation, a leading Fortune 500 global trading and business investment company, to launch the Spark Accelerator, a program to support early-stage startups to grow and scale their businesses.

Oct | 2023

M-PESA Foundation Supports Access To Health In Trans Nzoia And Homa Bay Counties

Over 3500 patients are expected to benefit from medical camps, funded by M-Pesa Foundation, in partnership with Zuri Health in Trans-Nzoia County and Flying Doctors in Homa Bay County.

Sep | 2023

M-PESA Foundation to construct KES 16 million maternal health complex in Kisumu County

About 10,000 people are set to benefit from a range of health services in Kisumu County after the M-PESA Foundation invested KES 16 million to construct a mother and child complex at Ratta Health Centre in Kisumu County. The construction and select equipping of the Maternal, Child and Neonatal complex and refurbishment of the existing labour room, delivery room and post-natal room will provide a conducive environment for mothers to deliver and enable the health centre to provide better services to more women.

Aug | 2023

M-PESA Foundation invests KES 34 million towards education projects in Homa Bay and Elgeyo Marakwet Counties

More than 570 learners in Homa Bay and Elgeyo- Marakwet Counties are set to enjoy better learning conditions after the M-PESA Foundation invested KES 34 million to renovate, construct and equip school infrastructure.

Jul | 2023

M-PESA Foundation Invests KES 27 million towards a maternal and child health unit in Makueni County

More than 15,000 residents of Mbooni East in Makueni County are set to benefit from improved maternal and child health services after the M-PESA Foundation and the county government opened a newly constructed Maternal and Child Health Unit at Tawa sub-County Hospital.

Jun | 2023

M-PESA Contributes KES 25M to 2023 WRC Safari Rally

M-PESA has announced a KES 25 million sponsorship for the 2023 WRC Safari Rally in Kenya. The sponsorship will support the Kenyan FIA Rally Stars Programme, benefiting McRae Kimathi, Jeremiah Wahome, and Hamza Anwar in the WRC3 category. Safaricom aims to nurture local sports talent and promote sustainability through a tree-planting initiative. The rally will feature renowned international drivers like Kalle Rovanpera and Sébastien Ogier.

May | 2023

Launching Fuliza Ya Biashara Overdraft With KCB

Safaricom and KCB Bank Kenya launched Fuliza Ya Biashara, allowing businesses on Lipa Na M-PESA Business Till to access overdrafts of up to KES 400,000 for 24 hours. This service aims to empower small businesses with instant credit for their operational needs. Over 538,000 businesses stand to benefit from this service, which addresses the gap in access to affordable credit faced by small and micro businesses due to their size and perceived risk.

Apr | 2023

Safaricom and HELB to Disburse Loans to M-PESA

Safaricom and the Higher Education Loans Board (HELB) launched the HELB Mobile Wallet and HELB M-PESA Mini App, enabling beneficiaries to receive their HELB loans directly to their M-PESA accounts. The HELB Mini App allows users to manage their accounts, access funds, repay loans, and view loan status and statements. The partnership aims to enhance the digital experience for HELB beneficiaries. Integration with other mobile money services will be introduced in the future.

Mar | 2023

M-PESA Africa Invests $2 Million in Shared Service Operations Centre

M-Pesa Africa inaugurated a Shared Service Operations Centre (SSOC) in Nairobi to oversee service operations and technical support across multiple countries. The SSOC will enhance service quality and platform reliability as M-Pesa expands to new markets and adds more products. The centre will support M-Pesa operations in Tanzania, the Democratic Republic of Congo, Mozambique, Lesotho, and Ghana and future markets. The move reflects M-Pesa's transition to a scalable, cloud-based platform.

Jan | 2023

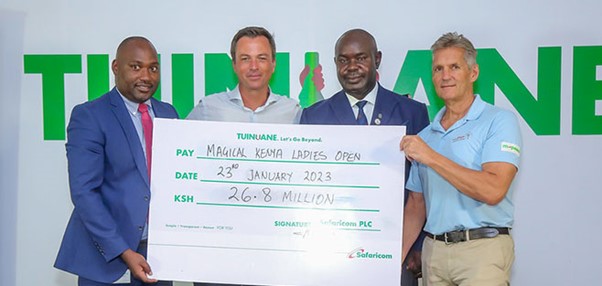

Magical Kenya Ladies Open sponsorship

Safaricom’s mobile money service, M-PESA, announced a KSh. 26.8 million sponsorship for the third edition of the Magical Kenya Ladies Golf Open. The Magical Kenya Ladies Open remains the only event of its kind and the highest ranked professional ladies’ tournament across the continent providing a unique opportunity for the development of upcoming female golfers in the region.

Dec | 2022

Safaricom revises tariffs effective 1st January 2023

Safaricom announced reduction in charges for Paybill and business to customer tariffs in an effort to ensure affordability and mitigate the prevailing economic challenges faced by customers. In the new changes, Bank to M-PESA charges have been reduced by average of 61%. Additionally, M-PESA to Bank charges have been reduced by an average of 47%. The reduced M-PESA to Bank tariff will also apply to all M-PESA Paybill payments that customers use for utilities such as electricity, hospital bills, schools, government payments etc. to ensure affordability.

Nov | 2022

Safaricom Launches M-PESA Go for 10- to 17-Year-olds

Safaricom launched M-PESA Go, a new financial product for teens and preteens aged 10 to 17 years. The service seeks to empower parents and guardians to raise a financially healthy generation who are prepared for a cashless world. M-PESA Go aims to improve digital money management and financial literacy among young Kenyans. It will enable users to send and receive money, buy airtime and bundles, use Lipa na M-PESA services, and access a customized version of the M-PESA Super App dubbed M-PESA Go App.

Nov | 2022

M-PESA Foundation, Flying Doctors’ Society of Africa partner to offer free fistula medical camp at KNH

Over 60 women living with fistula are expected to benefit from free surgeries and medical advice following a week-long medical camp at Kenyatta National Hospital (KNH) at a cost of KES 5,177,150. The partnership was officially launched last year in Webuye County Hospital and has provided fistula treatment and surgery to over 300 women in Bungoma, Kilifi, Nyeri, Kajiado and Tharaka Nithi counties.

Sep | 2022

Safaricom, NCBA and KCB Restructure Fuliza With Free Daily Fee

This move will see customers transacting on Fuliza access the overdraft facility at a free daily maintenance fee for the first three days for transactions of KSh. 1,000 and below. The move benefits more than 80% of M-PESA customers who seek to complete their payment transactions with Fuliza credit. Customers that borrow above KES 1,000 will also enjoy 10 – 20% discount on their Daily Maintenance Fee. The one-off Access fee, levied when customers access Fuliza remains unchanged at 1%, establishing Fuliza as the most accessible and affordable credit facility in the country.

Jul | 2022

M-PESA Foundation and Kenya Relief announce partnership

This will allow women and children in Migori County and beyond to access improved maternal and new-born healthcare services. The partnership which aims at reducing maternal and child deaths in the region will see the two organisations construct a 65-bed maternal unit which will provide prenatal, labor and delivery, post-partum, and post-operative services.

Jun | 2022

Safaricom and VISA launch M-PESA GlobalPay VISA virtual card

Safaricom and Visa, the global leader in digital payments, today introduced the first M-PESA GlobalPay Visa Virtual card. The launch of the new M-PESA Visa virtual card opens global shopping for Kenyan consumers, allowing secure cashless payments at merchant locations in over 200 countries through Visa’s global network.

Mar | 2022

Safaricom crosses 30 million monthly active M-PESA customers

Safaricom has today announced that M-PESA has crossed 30 million customers using the service every month in Kenya. The milestone comes a few days after M-PESA marked its 15th year since its launch on 6th March 2007. Kenya remains M-PESA’s most active market accounting for more than 30 million of the service’s 51 million customers across Kenya, Tanzania, the Democratic Republic of Congo, Mozambique, Lesotho, Ghana and Egypt.

Mar | 2022

M-PESA celebrates 15 years of transforming lives

M-PESA has marked 15 years since Safaricom and Vodafone launched the service in March 2007. From its beginning in Kenya, M-PESA has grown to more than 51 million customers, 465,000 businesses, 600,000 agents and 42,000 developers across Kenya, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana and Egypt. The service processes more than 61 million transactions a day making it Africa’s largest fintech provider.

Jan | 2022

Safaricom and NSSF to provide pension services through M-PESA mini app

Safaricom has partnered with NSSF to enable customers conveniently access services through the NSSF Mini App on the M-PESA Super App. Customers can register for NSSF membership, keep track of their contributions, top up and manage their NSSF account, and make Tenant Purchase Scheme (TPS) payments all within the M-PESA Super App.

Nov | 2021

M-PESA Foundation partners with Gertrude's Hospital Foundation for a Telemedicine Initiative

M-PESA Foundation and Gertrude’s Hospital Foundation have launched the Daktari Smart telemedicine program targeting over 32,000 children in Samburu, Homabay, Baringo and Lamu Counties. Two other counties will be brought on board in the next phase of this program. The project aims to reduce the number of referrals of sick children by allowing county health facilities to have access to specialists. It will also optimize the capacity and reach of healthcare delivery systems.

Oct | 2021

Safaricom and NHIF launch M-PESA mini app

Safaricom and the National Hospital Insurance Fund (NHIF) launched the NHIF mini-app within the M-PESA Super App. The NHIF mini-app will provide all NHIF services through the Super App, empowering customers to access services wherever they may be without visiting NHIF offices or downloading a separate app. Payment and account reconciliation services are already live on the mini-app, with procedure approvals set to become available soon.

Sep | 2021

M-PESA Africa celebrates 50 million active customers

Launched more than 14 years ago in Kenya, M-PESA is today available in Kenya, Tanzania, Mozambique, DRC, Lesotho, Ghana and Egypt. The milestone comes just 18 months after Safaricom and Vodacom launched the M-PESA Africa Joint Venture to accelerate growth of the service across the continent. M-PESA Africa has equally been striving to deliver digital platforms as part of its focus to be the largest fintech and digital ecosystem across the continent.

Jun | 2021

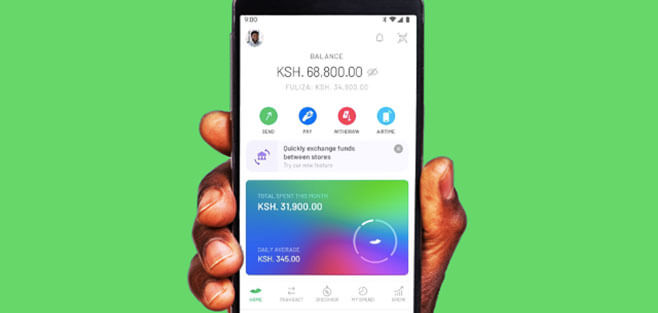

Safaricom launches M-PESA super app with offline mode and mini apps

Safaricom has launched “its M-PESA Super App for customers and its M-PESA for Business App with an “Offline Mode” and “Mini Apps”. The Offline mode” will enable customers to use the M-PESA Super App and complete transactions even without data bundles or when totally offline. With the offline mode, customers can send and receive money and equally make payments.

Jan | 2021

Safaricom launches M-PESA bill manager for businesses

Safaricom has announced the launch of an M-PESA Bill Management service. The innovation targets schools, landlords, utilities and other businesses with repeat payments, offering a platform where they can present and receive pending payments from customers, and issue electronic receipts. For M-PESA customers, the service offers a single point where they can view all their bills, receive reminders and automate payment of bills.

Dec | 2020

M-PESA tariff reduction

As part of different measures to help the country better weather the Covid-19 Pandemic, we announced the temporary zero-rating of M-PESA transactions in March.

Our regulator, the Central Bank of Kenya under the leadership of Dr. Patrick Njoroge has been instrumental in the formulation of this and other measures across the financial sector which have resulted in significant gains in the form of the ongoing economic recovery.

Nov | 2020

M-PESA is the first African Fintech platform to join united for wildlife financial taskforce

United for Wildlife is a coalition of charities that works to tackle the illegal wildlife trade. It was created in 2012 by The Royal Foundation, led by Prince William, The Duke of Cambridge. It has brought together conservation organisations, governments and global corporations to protect endangered species like elephants, rhinos, tigers and pangolins so they can share our world with future generations.

Sep | 2020

Lipa na M-PESA hits 200,000 business milestone

Launched in 2012, Lipa Na M-PESA empowers businesses to make and receive payments from any customer or any other business across the country. The service particularly caters to businesses by providing higher transaction and account limits, more secure payments and easy integration with business systems and other financial services.

Sep | 2020

M-PESA now available on *334#

Safaricom has today rolled out all its M-PESA services on the *334# menu. M-PESA on *334# targets non-smartphone users by consolidating all M-PESA services in a single, easy to use menu with more flexibility than is possible on the current SIM toolkit menu. The new menu makes it easier to send money to the correct recipient by displaying the receiver’s name and only advancing once the customer confirms the transaction.

Jun | 2020

Safaricom launches Lipa na M-PESA business app

Safaricom has announced a Lipa Na M-PESA Business smartphone app for the more than 170,000 merchants on the service. Named “M-PESA for Business“, it will empower business owners to access real-time statements, export statements, and track their business performance on the go.

Apr | 2020

Safaricom and VISA join forces in seeking to expand access to digital payments for M-PESA consumers and merchants

Safaricom, Kenya’s largest mobile operator, and Visa (NYSE: V), the global leader in digital payments have announced a partnership that will enable the development of products that will support digital payments for M-PESA customers. The partnership will cover over 24 million M-PESA customers, more than 173,000 Lipa Na M-PESA merchants from Safaricom and more than 61 million merchant locations throughout Visa’s global network, and over 3.4 billion Visa cards in more than 200 countries and territories, subject to regulatory approval.

Apr | 2020

Safaricom and Vodacom joint venture to accelerate M-PESA expansion

Safaricom and Vodacom announce that they have completed the acquisition of the M-PESA brand, product development and support services from Vodafone through a newly-created joint venture. The transaction, which was first announced in 2019, will accelerate M-PESA’s growth in Africa by giving both Vodacom and Safaricom full control of the M-PESA brand, product development and support services as well as the opportunity to expand M-PESA into new African markets.

Mar | 2020

NSSF to collect tenant purchase scheme instalments, service charge through M-PESA

Safaricom and the National Social Security Fund (NSSF) have announced a partnership to empower customers on the NSSF Tenant Purchase Scheme make monthly instalments through M-PESA. The service seeks to combat the spread of Coronavirus by providing the Scheme’s members with a cashless payment solution which helps them limit their movement and physical contact when making payments.

Jan | 2020

Safaricom and RIA money transfer to power international money transfers with M-PESA

Safaricom has partnered with Ria Money Transfer, subsidiary of Euronet Worldwide, Inc. (NASDAQ: EEFT), to empower more than 26 million M-PESA customers to conveniently receive international money transfers from over 20 countries across the world. A global leader in cross-border money transfers, Ria has the second largest money transfer network in the world with 389,000 locations across 161 countries.

Apr | 2019

SAFARICOM AND BUUPASS PARTNERSHIP

Safaricom partners with BuuPass to launch an online service where travelers in the country can book and purchase bus tickets. The service is available with five bus operators including Easy Coach, Modern Coast, Greenline, Palmers and East African Shuttles, and looks to onboard more.

Apr | 2019

LAUNCHING A FRAUD INTELLIGENCE SOLUTION

As part of the M-PESA APIs Safaricom has launched a fraud intelligence solution for financial institutions in the country. The service will help banks, micro-finance institutions and insurance firms to reduce fraud incidences targeting their customers by providing them with a tool that helps.

Mar | 2019

M-PESA GROWTH METRICS

22.6 Million Active Customers, 167,000 M-PESA Agents.

Mar | 2019

PARTNERSHIP WITH ALIEXPRESS

Safaricom and Ant Financial Services – the world’s largest Fintech services provider – announce a partnership that will allow Kenyans shopping on AliExpress to pay for their purchases using M-PESA. The move especially targets micro-traders in the country who source for goods and other supplies

Mar | 2019

NSSF PARTNERS WITH M-PESA IN CASHLESS DRIVE

The National Social Security Fund (NSSF) has partnered with Safaricom as it embarks on a push to fully adopt cashless payments. Under the initiative, NSSF will implement an entirely cashless system at all its branch network across the country.

Feb | 2019

PARTNERSHIP WITH KAPS TO ENABLE M-PESA PARKING PAYMENT

Safaricom has partnered with KAPS to enable motorists across the country to pay for their parking through M-PESA. The partnership will see the service provider integrate M-PESA to their platform, allowing cashless payments at more than 50 locations including malls and hospitals for the first time.

Feb | 2019

‘SHUKRANI KOCHOKOCHO’ CAMPAIGN

10 week-campaign rewards more than 5 million Safaricom customers with more than KES 250 million in prizes. More than 100 Safaricom customers walk away with KES 1 million cash prize each. Customers earn ten entries for every KES 20 top-up, and one entry for every KES 20 transacted on M-PESA.

Nov | 2018

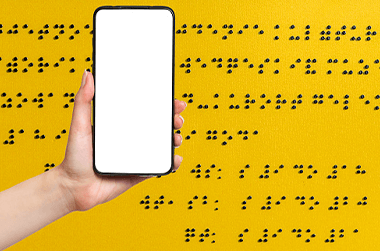

DOT BRAILLE WATCH TO ENABLE EASIER M-PESA ACCESS FOR VISUALLY IMPAIRED

Persons living with visual impairment/blindness can now access M-PESA messages independently in braille format and conduct financial transactions with confidentiality, following the introduction of the DOT Braille Watch. The Dot Braille Watch is an innovation that is an equivalent of a smart gear...

Nov | 2018

FASTER TRANSACTIONS FOR M-PESA MERCHANTS

Safaricom deploys faster and more private cashless payments at over 2,500 Lipa Na M-PESA merchants. The move is set to benefit more than 21 million monthly active M-PESA customers with faster transactions and increased privacy by eliminating the need to show transaction confirmation messages.

Nov | 2018

M-PESA PARTNERS WITH WESTERN UNION

M-PESA Global, a new and revolutionary service that opens up M-PESA to the world launched. Anyone in the world can send money to any M-PESA customer in Kenya. In a first of its kind, all M-PESA customers can now send money to almost any individual across the world including to bank accounts

Jun | 2018

M-PESA LOYALTY PROMOTION

10 week “Maisha Ni M-PESA Tu” promotion will reward customers every time they send and receive money, transfer money from a bank account to M-PESA and for all Lipa Na M-PESA transactions. Customers qualify to win one of seven apartments or KES 300 million in weekly prizes. M-PESA agents also stand...

Apr | 2018

SAFARICOM ENABLES PAYPAL AND M-PESA TRANSACTIONS

PayPal and TransferTo announce a collaboration on a new service that will allow movement of funds between M-PESA and PayPal accounts, a huge boost to international eCommerce.

Apr | 2018

M-PESA AWARDED GSMA MOBILE MONEY CERTIFICATION

M-PESA scores another feat after successfully passing the GSMA Mobile Money Certification, a global initiative that defines and promotes excellence in the provision of mobile money services. The service met the criteria in 8 areas of assessment.

Mar | 2018

LAUNCHING LIPA NA M-PESA CASH BACK PROMOTION

Two month Customer reward campaign dubbed Lipa Na M-PESA Cash Back Promotion launched to bolster the usage of Lipa Na M-PESA for retail purchases. Customers who meet their weekly target receive monetary amounts ranging from Ksh 5 to Ksh 100.

Mar | 2018

M-PESA GROWTH METRICS

28.64 Million Registered Customers and 20.5 Million active customers. 156,500 agents.

Dec | 2017

LAUNCHING M-PESA FOR VISUALLY IMPAIRED CUSTOMERS

A world first, Visually Impaired customers will have their balances read out to them with additional M-PESA services gradually being introduced in coming months.

Dec | 2017

M-SHWARI, KCB M-PESA AND QR CODES ON SAFARICOM APP

M-PESA customers can now access all M-Shwari and KCB M-PESA functions on the Android and iPhone App. Additional features include Lipa Na M-PESA Bill Manager, and making Lipa Na M-PESA payments by scanning a QR code.

Oct | 2017

M-PESA 1TAP AVAILABLE IN MORE TOWNS

Following successful trials over the last four months in Nakuru, Safaricom extends availability of M-PESA 1Tap in Nairobi, Mombasa, Kisumu, Eldoret and Nyeri. Customers can obtain an M-PESA 1Tap wristband, phone sticker or card and tap to pay on merchant terminals.

Sep | 2017

UPGRADES ON M-PESA PLATFORM

Feature-rich M-PESA Application Programming Interfaces (APIs) portal open to all developers and businesses in the country. Daraja will enable businesses to easily integrate with M-PESA

Sep | 2017

M-PESA GROWTH METRICS

19.3 Million Active Customers, 148,000 M-PESA Agents.

Aug | 2017

SIMPLIFIED ACCESS TO M-PESA APIs FOR BUSINESSES

Feature-rich M-PESA Application Programming Interfaces (APIs) portal open to all developers and businesses in the country. Daraja will enable businesses to easily integrate with M-PESA.

Mar | 2017

SAFARICOM CUTS LIPA NA M-PESA TARIFFS BY HALF, ANNOUNCES M-PESA APP

Safaricom implements a 50% tariff reduction for all Lipa Na M-PESA Buy Goods merchant fees. Under this new Lipa Na M-PESA tariff, merchants will be charged a maximum of 0.5% of the transaction amount, down from 1%.

Mar | 2017

10TH ANNIVERSARY

M-PESA Turns 10

Feb | 2017

COST INFORMATION SENT TO CUSTOMERS

M-PESA customers start receiving information on the cost of each transaction.

Dec | 2016

DAILY TRANSACTIONS

More than 10.3 million transactions are done on M-PESA every day.

Dec | 2016

FINDINGS BY MIT AND GEORGETOWN UNIVERSITY

A Study by MIT and Georgetown University finds that since 2008, M-PESA has lifted over 194,000 families - or 2% of Kenyan households - out of extreme poverty.

Dec | 2016

INTERNATIONAL MONEY TRANSFER EA

International Money Transfer EA – Customers are able to carry out Inbound and outbound money transfer across East Africa in partnership with MTN and Vodacom.

Nov | 2016

M-PESA KADOGO

M-PESA Kadogo – peer to peer, paybill and buy goods transactions for Ksh.100 and below zero rated to further deepen financial inclusion at the bottom of the pyramid.

Nov | 2016

TRUE VALUE REPORT

True Value, M-PESA contributed Kshs. 184 Billion to the Kenyan economy excluding transaction fees

Sep | 2016

TRANSACTIONS REPORT

Kshs. 3.2 Trillion transacted between 1st April 2016 and 30th September 2016.

Sep | 2016

REGISTERED AND ACTIVE M-PESA CUSTOMERS

24.8 Million registered customers with 17.6 Million active customers, 114,000 M-PESA agents

Aug | 2016

KCB M-PESA

KCB M-PESA loan disbursements hit the Kshs. 10 Billion mark

Jun | 2016

CARREFOUR

Carrefour, the world’s second largest hypermarket chain fully integrates Lipa Na M-PESA paving the way for the retailer to fully adopt M-PESA as a payments channel in Kenya.

Jun | 2016

BILL MANAGER

A new service that will enable customers to manage and pay bills via M-PESA all in a single transaction, by dialing *234*1*3#

Mar | 2016

TRANSACTIONS REPORT

Kshs. 5.9 Trillion transacted between 1st April 2015 and 31st March 2016.

Mar | 2016

M-PESA GROWTH METRICS

22 Million registered customers with 15.7 Million active customers, 91,200 M-PESA agents. M-Shwari deposits at Kshs. 6.9 Billion on deposit and Kshs. 5 Billion on loan. KCB M-PESA Kshs. 5 Billion on deposit and Kshs. 1.2 Billon on loan.

Jan | 2016

ACCESS TO M-PESA STATEMENTS

A customer is able to access their M-PESA statements by dialing *234# from their handsets and follow prompts to enter the preferred email address to which they would like their M-PESA statements sent. Customers have an option of accessing one-off statements for three; six or 12 months in one go.

Dec | 2015

M-PESA GROWTH METRICS

Deposit Value of Kshs. 125,298,015,514 Billion. Withdrawals of Kshs. 107,065,238,244 Billion. Transfers of Kshs. 107,396,348,247 Billion. B2C of Kshs. 29,303,669,495 Billion. C2B of Kshs. 24,536,550,463 Billion. Airtime value of Kshs. 4,868,556,607 Billion. M-KESHO Deposits Value of Kshs. 2,364,464,562 Billion. Buy Goods Value of Kshs. 2,364,464,562 Billion. IMT Value of Kshs. 1,011,196,047 Billion.

Dec | 2015

M-TIBA

This is a mobile centric platform approach that seeks to provide better coordination of Health care services between payers, patients and providers

Dec | 2015

LIPA NA M-PESA SHINDA NYUMBA PROMOTION

Safaricom M-PESA customers and over 18,000 merchants stand to win three three-bedroomed houses, airtime or cash in a Sh118 million festive push for Lipa Na M-PESA. A promotion targeting consumers and merchants who make their payments using the mobile money wallet through activities such as the Lipa Na M-PESA Shinda Nyumba promotion to drive our growth in the Lipa Na M-PESA financial service transactions during the festive season.

Nov | 2015

NEW KCC CASHLESS SOLUTION

Safaricom formed a partnership with Kenya Co-operative Creameries (KCC) to deploy a KES 55.7 million cashless payments service to enhance business efficiency and address the risks associated with cash handling. Through a mobile application, over 200 sales and distribution agents for New KCC will be able to place and process orders, access live delivery reports, create invoices and make payments. The app will also generate regular reports to ensure accountability and for record keeping.

Oct | 2015

HAKIKISHA

A service that allows customers to confirm the name of the recipient before sending funds, withdrawing funds and paying bills

Sep | 2015

1ST M-PESA DEVELOPERS INITIATIVE

Safaricom opened up the API for M-Pesa to third-party developers, a move that will encourage innovation and attract more traffic onto the mobile money system.

Sep | 2015

#1 FORTUNE CHANGE THE WORLD LIST

Fortune ranks M-PESA first in Change The World List. The list recognizes companies that have made significant process in addressing major social problems as part of their core business strategy. “M-PESA has been revolutionary, changed lives and businesses, and brought substantial flows into the financial system that would have otherwise been lying literally under the mattresses”

Jul | 2015

REALTIME SETTLEMENT (RTS)

A service that allows partners to receive funds after withdrawal from their merchant tills real-time in their bank account So far 17 banks have been on boarded for the RTS service. Equity Bank, Kenya Commercial Bank, Co-operative Bank, Diamond Trust Bank, NIC Bank, Standard Chartered Bank, Consolidated Bank, CFC Stanbic Bank, National Bank of Kenya, Chase Bank, Bank of Africa, Gulf African Bank, Commercial Bank of Africa, First Community Bank, Credit Bank Kenya, United Bank For Africa & Jamii Bora

Apr | 2015

E-CITIZEN

Safaricom partners with the Government of Kenya to provide one Paybill number 206206 for use in payment of government services through the governments e-citizen platform

Apr | 2015

M-PESA G2 PLATFORM

Migration of the current M-PESA G1 platform to an enhanced G2 platform that will allow for faster transactions, improved stability as well as enable more functionality from the service.

Mar | 2015

M-PESA SURE PAY

Safaricom launches a new service that allows organizations e.g WFP to track funds sent to beneficiaries via M-PESA

M-PESA customers now able to send and receive money to and from Tanzania

Safaricom and KCB launched a mobile savings and loan product

Dec | 2014

M-PESA GROWTH METRICS

Deposit Value of Kshs. 104,955,132,618 Billion. Withdrawals of Kshs. 90,264,165,528 Billion. Transfers of Kshs. 92,116,902,245 Billion. B2C of Kshs. 14,183,972,826 Billion. C2B of Kshs. 14,767,038,267 Billion. Airtime value of Kshs. 3,954,745,855 Billion. M-KESHO Deposits Value of Kshs. 2,036,686,967 Billion. Buy Goods Value of Kshs. 5,647,048,109 Billion. IMT Value of Kshs. 565,608,224 Million.

Dec | 2014

FUEL WITH LIPA NA M-PESA

Safaricom begins incentive campaign that rewards customers with airtime every time they pay for their fuel with Lipa Na M-PESA.

Nov | 2014

MONEYGRAM PARTNERSHIP

MoneyGram partners with M-PESA on International Money Transfer to enable consumers in over 90 countries to send money directly to M-PESA customers.

Aug | 2014

M-PESA TARIFF REVIEW

Safaricom reduces person to person transfer fees in the most popular low and medium bands (Kshs. 10 to Kshs. 1,500) by up to 67% . Costs for sending amounts above Kshs. 1,500 rationalised at 0.8% of the value.

Jun | 2014

M-SHWARI LOCK SAVINGS

This is a savings account that allows M-Shwari customers to save fund for a defined purpose, for a specified amount and within a specified period

May | 2014

M-PESA AND M-SHWARI APIs

API upgrade cuts down the time it takes for mobile money transactions from 2 hours to less than 30 seconds. API also provide for instant transfers between Banks and M-PESA, and other M-PESA integrations.

Apr | 2014

M-SHWARI PARTNERSHIP

Safaricom, CBA and MultiChoice partner to enable customers purchase GOtv decoders through M-Shwari credit.

Feb | 2014

M-SHWARI GROWTH METRICS

Over Kshs. 7.8 Billion disbursed in loans and more than Kshs. 24 Billion deposited in M-Shwari since launch

Jan | 2014

LINDA JAMII

Safaricom, Britam and Changamka partner to launch Linda Jamii, a micro-insurance medical product targeting Kenya’s uninsured, from as low as Kshs. 12,000 per annum.

Oct | 2013

M-PESA GROWTH METRICS

Deposit Value of Kshs. 93,273,000,000 Billion. Withdrawals of Kshs. 79,917,000,000 Billion. Transfers of Kshs. 84,882,000,000 Billion. Other values amounted to Kshs. 25,610,000,000 Billion. Airtime value of Kshs. 3,551,000,000 Billion

Aug | 2013

LIPA KODI

This is a service that allows property owners to collect rent conveniently and at no cost. Property agents sign up for a pay bill account which their tenants pay rent to at their convenience.

Jun | 2013

LIPA NA M-PESA

This is a service that allows consumers to pay for goods and services using M-PESA. The buy goods and services functionality is available on your M-PESA Menu under “Lipa na M-PESA” . Merchants acquire a 6 digit number where customers make payments to at no extra cost. This service offers security of...

Jun | 2013

SHORT TERM PAY BILL

Short Term M-PESA Pay Bill is an M-PESA Pay Bill Account that can be used for short term fundraising purposes for people who want to raise money for a specific period of time for a specific activity. Funds can be raised for Education, weddings, medical or funerals.

Mar | 2013

M-PESA CUSTOMER GROWTH

17,000,000 Million active M-PESA users

Nov | 2012

M-SHWARI

This is a revolutionary banking product exclusively for M-PESA customers provided by Commercial bank of Africa (CBA) in partnership with Safaricom. M-Shwari provides financial access to millions of Kenyans who previously had no access allowing them access micro savings and micro credit straight from...

Nov | 2012

SHORT TERM PAY BILL

Short Term M-PESA Pay Bill is an M-PESA Pay Bill Account that can be used for short term fundraising purposes for people who want to raise money for a specific period of time for a specific activity. Funds can be raised for Education, weddings, medical or funerals.

Nov | 2012

M-PESA GROWTH METRICS

Deposit Value of Kshs. 73,723,000,000 Billion. Withdrawals of Kshs. 64,602,000,000 Billion. Transfers of Kshs. 73,933,000,000 Billion. Other values amounted to Kshs. 15,288,000,000 Billion. Airtime value of Kshs. 2,919 ,000,000 Billion

Sep | 2012

RELAX…YOU’VE GOT M-PESA

This was rooted in the convenience that M-PESA brings to customers. The campaigns objective was to encourage the use of other M-PESA services e.g. pay bill, buy goods, Bank to M-PESA etc. This campaign was supported by the first ever M-PESA promotion “ Timiza na M-PESA” which saw one Kenyan lady...

Apr | 2012

M-PESA CUSTOMER GROWTH

15,000,000 Million active M-PESA users

Feb | 2012

M-PESA AND GRUNDFOS WIN GSMA AWARD

Best Product-Service Initiative for the Underserved Segment. In September 2009 listed telecoms operator Safaricom entered into a partnership with Grundfos LifeLink, part of the Danish worldwide pump manufacturer Grundfos, that allows rural communities to access safe water and pay for it through...

Dec | 2011

M-PESA GROWTH METRICS

Deposit Value of Kshs. 61,253,000,000 Billion. Withdrawals of Kshs. 55,345,000,000 Billion. Transfers of Kshs. 63,867,000,000 Billion. Other values amounted to Kshs. 8,173,000,000 Billion. Airtime value of Kshs. 2,446 ,000,000 Billion

Nov | 2011

AFRICOM AWARD

Safaricom, won two AfricaCom 2011 awards for innovative technology and life changing solutions in Africa. The company bagged Changing Lives Awards, for the successful Kenyans for Kenya fundraising initiative and Best ICT Solution Provider for Enterprise Markets in Africa for its tele-presence.

Aug | 2011

KENYANS FOR KENYA PAY BILL NUMBER

The campaign was created to ensure that donations as low as Sh10 were harnessed, as this was to go a long way in improving the situation of millions of Kenyans staring starvation and death in the eye. Donations were sent to the M-PESA Pay Bill number 111111 at no charge. The campaign managed to raise a total of Ksh 167,678,289 via M-PESA donations.

Mar | 2011

M-PESA SERVICE GOES GLOBAL VIA ALLIANCE WITH WESTERN UNION

Safaricom and Western Union signed an agreement that allowed M-PESA’s 13.5 million customers to receive international money transfers from 45 countries and territories including the U.S, Canada, Italy and the U.K.

Mar | 2011

DEACONS KENYA CUSTOMERS TO PAY VIA M-PESA

M-PESA expanded its level of customer satisfaction by making an agreement with Deacons Kenya Limited.

M-PESA celebrates its 4th Anniversary with it's 13,798,695 active mobile users.

Feb | 2011

M-PESA INTERNATIONAL PREPAY VISA CARD

Safaricom partenered with I&M Bank to give M-PESA a whole new facet. The agreement allowed customers to transfer money from their M-PESA accounts into an international Visa Pre-Paid Card known as the M-PESA PrePay Safari Card.

Dec | 2010

M-TICKETING OFFERS TICKETS ON YOUR MOBILE

M-PESA customers were now enabled to book and pay for tickets to concerts, events, galas, and even sports activities right on their mobile phone courtesy of a new service called M-TICKETING

Dec | 2010

DIVIDEND PAYMENTS ON YOUR PHONE

Safaricom shareholders are a special part of the Safaricom Family. To make them feel more appreciated and make accessibility to dividends easier, Safaricom allowed them to receive their dividend payments through M-PESA.

Dec | 2010

M-PESA GROWTH METRICS

Deposit Value of Kshs. 39,992,000,000 Billion. Withdrawals of Kshs. 35,313,000,000 Billion. Transfers of Kshs. 41,639,000,000 Billion. Other values amounted to Kshs. 3,159,000,000 Billion. Airtime value of Kshs.1,280,000,000 Billion

Oct | 2010

NUNUA NA M-PESA

As M-PESA continued to make life easier in every way possible, Safaricom partnered with several leading supermarkets.

In a milestone that re-defined the Kenyan shopping experience, customers were given an avenue to pay for their goods at supermarkets using M-PESA.

May | 2010

M-KESHO BANK ACCOUNT AT EQUITY

Safaricom and Equity Bank partnered to bring customers bank accounts into their pockets. With the offering of a new banking system that allows the customer to manage their bank accounts via mobile

Feb | 2010

M-PESA WINS BEST MOBILE TRANSFER SERVICE AWARD

M-PESA was designated the Best Mobile Transfer Service for the second year in a row, M-PESA won the Best Mobile Transfer Service for the second year running, proving that its first win was well earned.

The previous year, judges felt that: 'M-PESA will serve as a blueprint for other operators around the world.'

Oct | 2009

MOBILE CONTENT AWARD

Best Mobile Transfer Service.

Sep | 2009

M-PESA AND GRUNDFOS PROJECT

Grundfos LIFELINK is a firm that manufactures pumps and helps rural residents to access safe water. Safaricom partnered with Grundfos to allow these residents to pay for their water through the M-PESA.

May | 2009

M-PESA - KCB PARTNERSHIP TO EASE AGENT ACCESS TO E-FLOAT

The agreement facilitated Agent to Agent transactions that improved M-PESA usage for both agents and customers.

Safaricom made life easier for customers of SMEP (Small and Micro Enterprise Programme ), a Kenyan micro-financier working with small businesses.

Apr | 2009

EXTENDING M-PESA SERVICE TO KPLC CUSTOMERS

No more queueing at Kenya Power centres. Safaricom partnered with Kenya Power (then known as KPLC) to allow customers to pay their electricity bills via M-PESA.

Feb | 2009

M-PESA WINS BEST MOBILE TRANSFER SERVICE AWARD

M-PESA was designated the Best Mobile Transfer Service, with the judges calling it: "An accessible and intuitive solution, reflected by an unprecedented take-up rate for a service of this kind."

Dec | 2008

M-PESA SERVICE PARTNERS WITH WESTERN UNION

Safaricom and Western Union signed an agreement that allowed M-PESA's 5 million customers to receive money from the U.K.

Nov | 2008

AFRICACOM AWARDS

Best Business Solution for Rural Services

Oct | 2008

SAFARICOM AND OLD MUTUAL SIGN DEAL

To make it easier for investors to manage their Old Mutual accounts, Safaricom and Old Mutual Kenya formed a partnership. The partnership allowed investors to top up their Old Mutual Unit Trusts using M-PESA.

Sep | 2008

WORLD BUSINESS AND DEVELOPMENT AWARD

An increase by more than 1 Million active users in less than 4 months. 4,143,043 active mobile M-PESA users..

M-PESA won the World Business & Development Award for its contribution towards millennium development goals.

Aug | 2008

M-PESA ACCESS AT POSTBANK

To give M-PESA customers better access to the service, Safaricom signed an agreement with PostBank to allow customers to access M-PESA services at all PostBank branches.

Jul | 2008

ATM WITHDRAWAL SERVICES PESAPOINT

M-PESA Agents were not always available, especially after hours. To overcome this challenge, Safaricom and PesaPoint entered into a partnership. It allowed M-PESA users to withdraw money from PesaPoint ATMs directly on their Safaricom line. No ATM Cards are necessary for the PesaPoint withdrawals.

Jun | 2008

3 MILLION M-PESA USERS

M-PESA attained a customer base of 3 million customers. The service became ubiquitous as an income earner and economic facilitator in both rural and urban areas.

May | 2008

M-PESA OUTLETS AT CALTEX STATIONS

M-PESA crossed from handsets to petrol stations as Safaricom signed an agreement with Chevron Kenya Ltd.

M-PESA was awarded as the best project in the Economic Development Category of the Stockholm Challenge Awards.

Mar | 2008

HOUSING FINANCE SIGN M-PESA SERVICE DEAL

To increase accessibility to subscribers, Safaricom partnered with Housing Finance to offer M-PESA services from Housing Finance outlets all over the country..

M-PESA became an economic phenomenon as it signed up it's 2 millionth M-PESA customer

Feb | 2008

M-PESA WINS GSMA AWARD

Safaricom's M-PESA "Send Money Home" campaign won the Best Broadcast Commercial award at the 13th Annual GSMA Global Mobile Awards in Barcelona, Spain. It also scooped another award for Best use of Mobile for Social and Economic Development.

Apr | 2007

M-PESA CUSTOMER GROWTH

19,671 mobile active M-PESA users

Nov | 2007

1 MILLION M-PESA USERS!

1,041,522 mobile active M-PESA users.

Mar | 2007

M-PESA LAUNCH

And this is where the story begins...

, how can I help you today?

, how can I help you today?