True value assessment

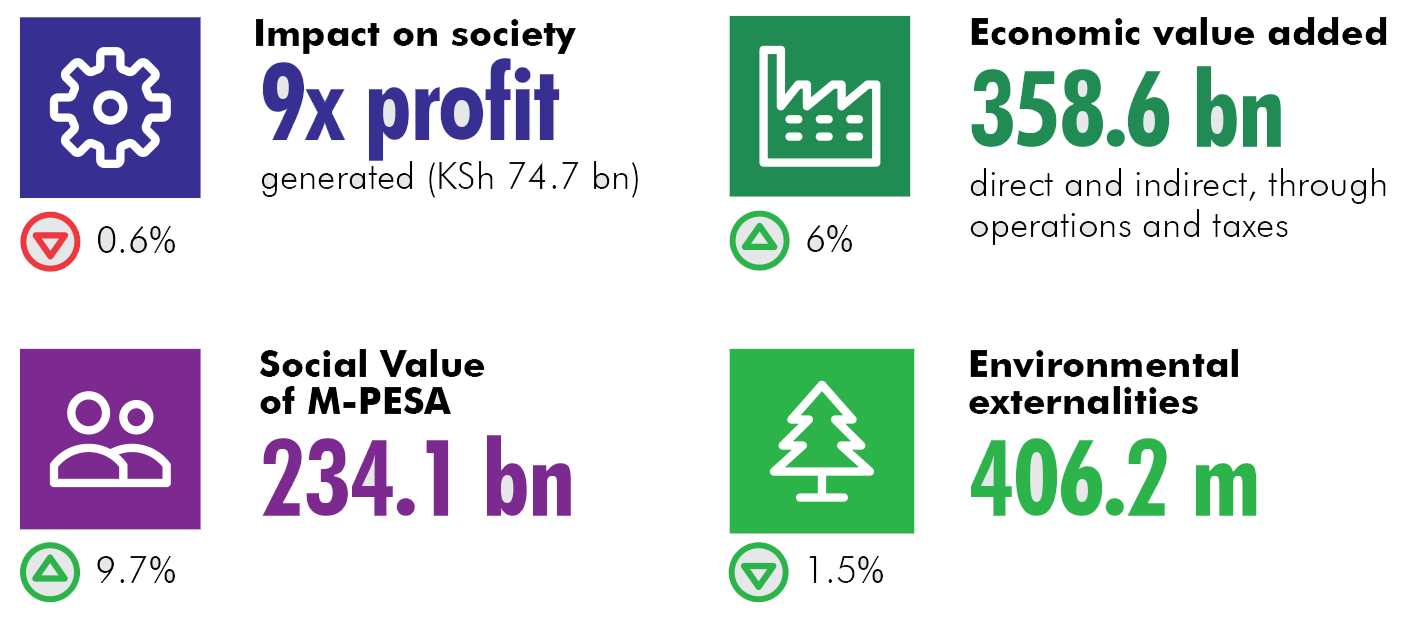

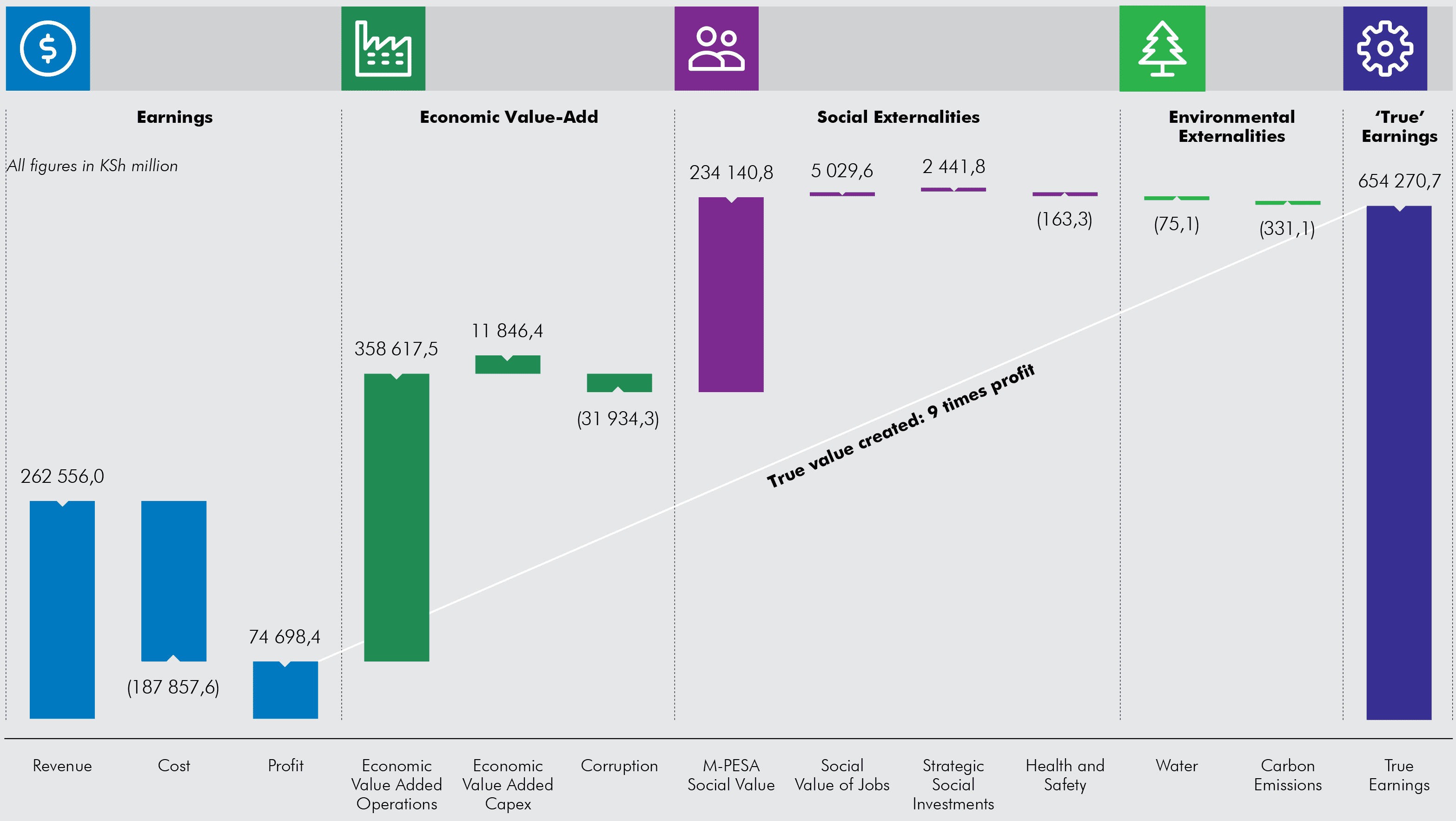

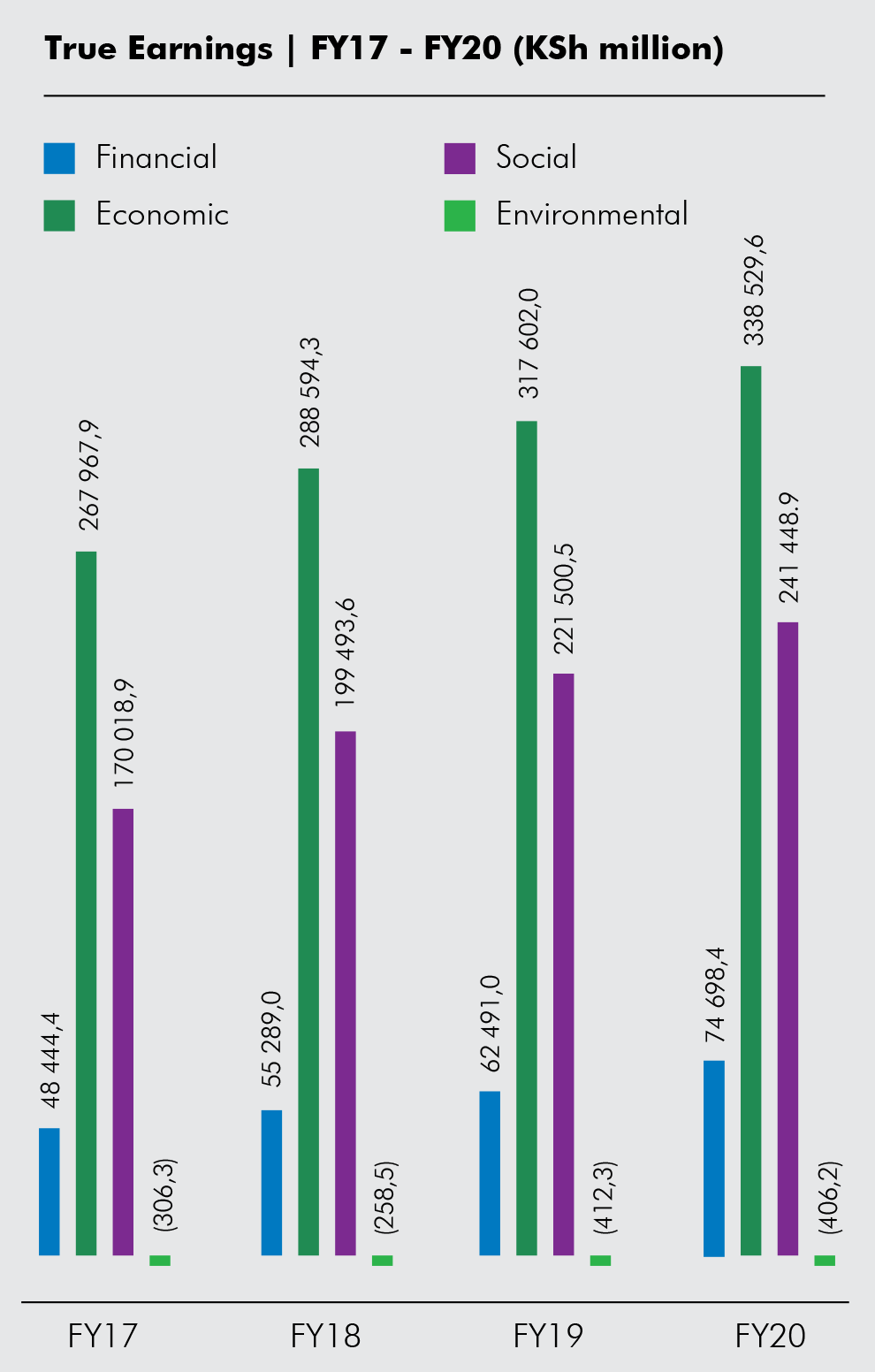

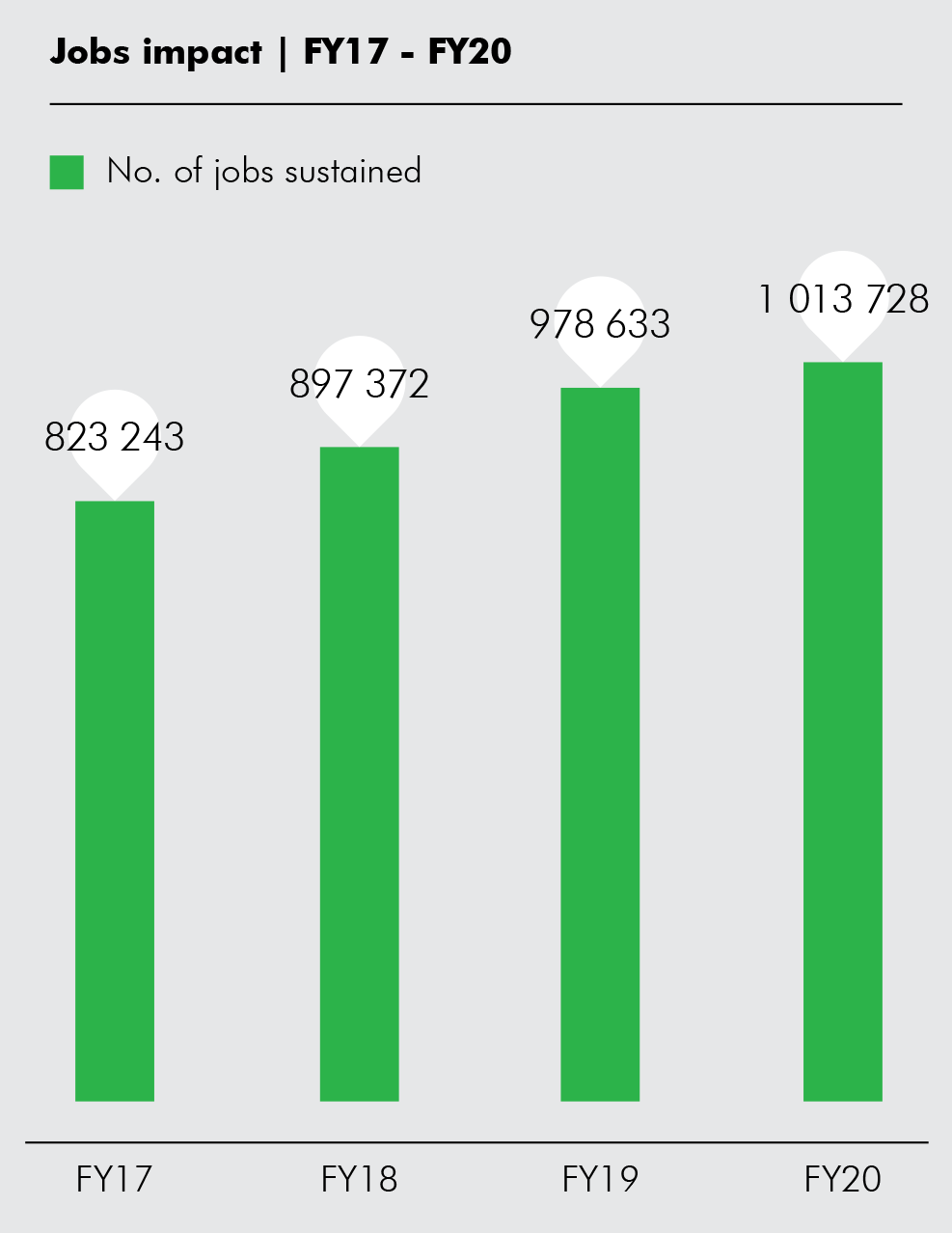

We monitor and measure our contribution to Kenyan society continuously. One of the ways in which we evaluate our role is by assessing the significant indirect value contribution we make to the economy, society and environment in Kenya. We use a structured impact modelling tool – the KPMG “True Value” methodology – to quantify the positive and negative impact of the organisation on society, the environment and the economy in monetary terms. The following “True Earnings” bridge highlights our resilience as a business and strong fundamentals by showing that the total value we created for Kenyan society in FY20 was KSh 654 billion, around nine times greater than the financial profit we made during the year, and that we sustained over 192 747 direct and indirect jobs.

The following is an independent analysis of Safaricom True Earnings by KPMG.

![]() True Value: Impact on society

True Value: Impact on society

The True Value assessment calculates that Safaricom sustained over 192 747 direct and indirect jobs during the year and, if the wider effects on the economy are included, this number increases to over 1 013 728 jobs.

![]() Definitions

Definitions

True Value: A three-step methodology that enables companies to (i) assess their ‘true’ earnings including externalities, (ii) understand future earnings at risk and (iii) develop business cases that create both corporate and societal value.

True Earnings: The first step of the True Value methodology, which quantifies and monetises the material externalities of a company.

Total Economic Value: The nature and magnitude of the contribution to the Kenyan economy made by Safaricom.

Induced economic impact: Operational and capital expenditure by Safaricom will create additional employment and also benefit the employees of our suppliers. A share of the additional income generated in this way will be spent on the consumption of goods and services, which, through linkages and multiplier effects, will benefit the broader economy by stimulating additional demand for the products and services produced within that economy.

We remain committed to our purpose of transforming lives. Our latest True Value Report indicates that the true value to Kenyan society created by Safaricom (the cumulative outcome of the economic, social and environmental impacts highlighted on the True earnings bridge) increased by nine per cent to KSh 654 billion, nine times the financial profit the company earned during the same period, and we contributed a total of 6 per cent to the gross domestic product (GDP) of the country. We continue to leverage the power of mobile technology to deliver shared value propositions that disrupt inefficiencies and impact lives positively in the health, agriculture and education sectors.