OUR NETWORK

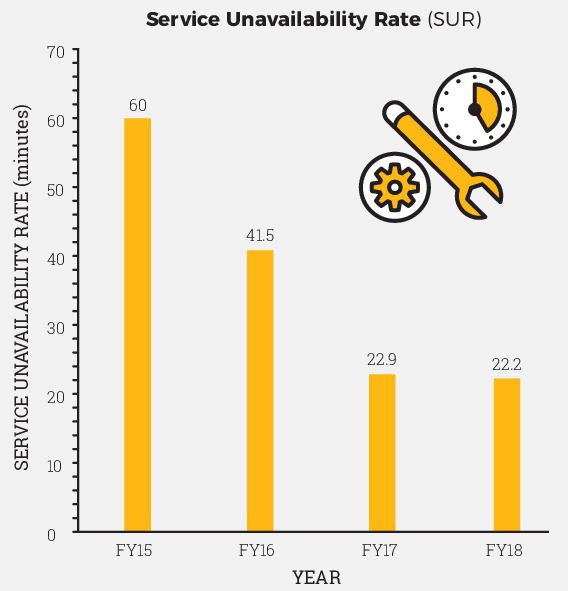

Our network remains a material topic from a sustainability perspective because it is essential to our business. It is a fundamental aspect of our operations as all of the services we provide to our customers are delivered through the network platform. It is also the medium through which we reach stakeholders and transform lives through our wide range of products and services. The quality, coverage and availability of our network impacts our business as it provides us with a competitive advantage,allowing us to differentiate ourselves in a highly competitive industry.

As part of our ongoing commitment to the SDGs in the expansion and maintenance of our networks, we aligned our efforts with five of the goals during the year: fostering a conducive work environment (SDG8) by putting the safety of all staff and our partners first, by ensuring that all staff are treated equally, and by promoting and supporting Diversity and Inclusion (SDG10); entrenching the use of energy-effi cient technologies (SDG7) within our environmentally friendly installations and our facilities; and extending coverage of our services and offering an excellent network experience to society in general (SDG9).

Our network is the core of our business and the medium through which we transform lives.

KEY FOCUS AREAS DURING THE YEAR

• Digital Telco migration

(using automated performance monitoring and data-driven insights to improve network)

• Net Zero by 2050

(road map of activities and targets to achieve our goal)

• Converged Billing System (CBS) upgrade

(successful migration to CBS v5.5)

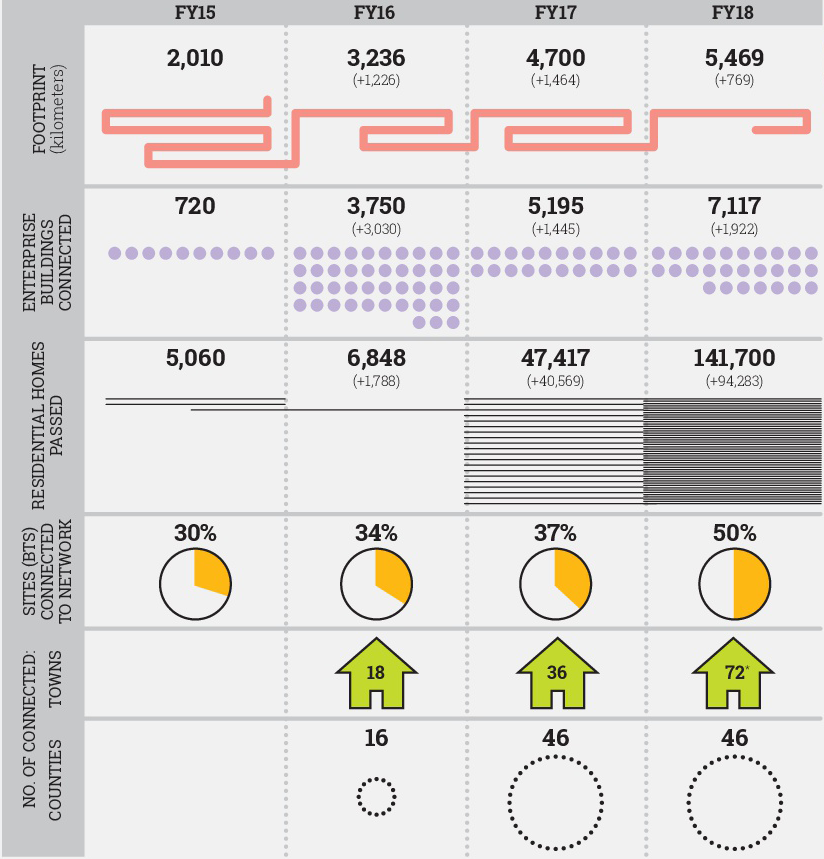

• Aggressive expansion of fibre optic network

(fast tracking budgets, securing materials on time and expanding number of partners)

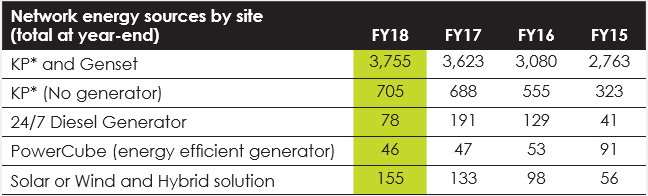

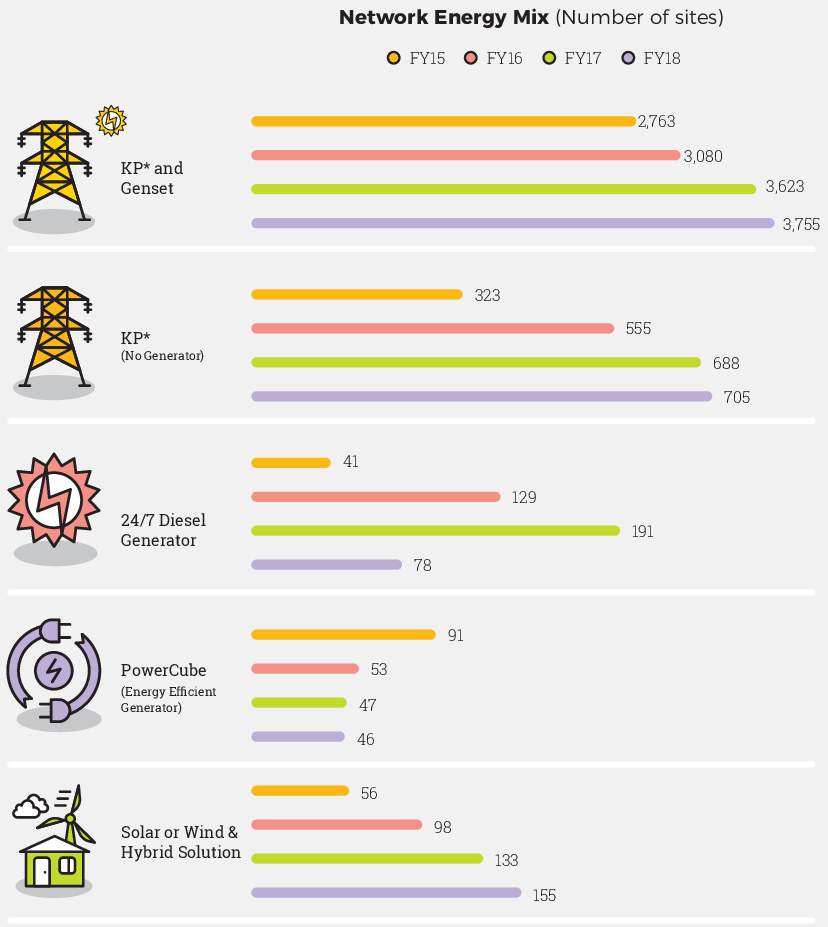

• Energy efficiency and sustainability

(optimising energy consumption patterns and focusing on sustainable energy

sources)

BEST NETWORK IN KENYA

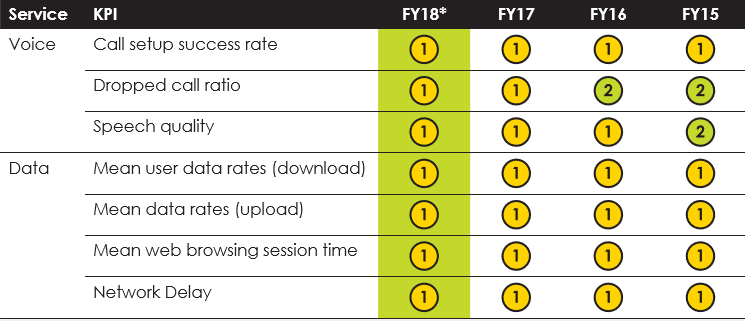

Independent Quality of Service (QoS) testing is one of the main indicators we use to monitor and manage the quality of our network. We have yet to receive the results of the P3 Communications QoS tests for the period under review, but we have adopted the P3 methodology internally and have published our internal testing results using the exact same measurements in the interim.