2015 SUSTAINABILITY REPORT

Governance, Risk and Regulation

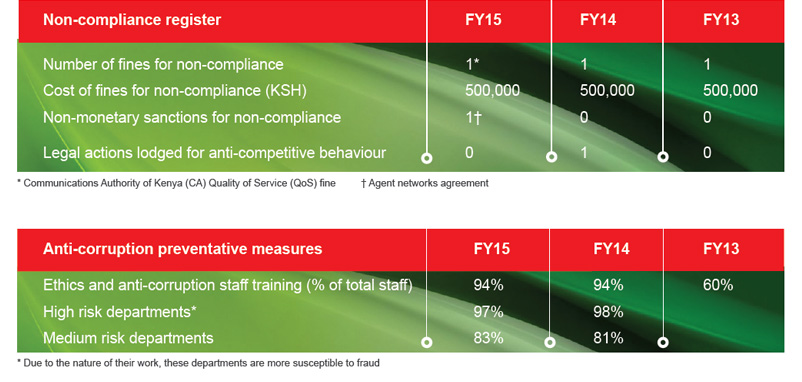

Strong corporate governance, ethical behaviour, robust risk management and regulatory compliance form the foundation upon which we build and sustain value. These are fundamental to commercial sustainability and investor trust and, of such importance, we consider them to be material matters. Without the correct corporate checks and balances in place, the positive reputation and trust we enjoy as an organisation could be damaged. If we fail to comply with relevant regulations, we are likely to suffer penalties, fines, other remedial sanctions and reputational damage.

Performance Highlights

Management approach

From a governance perspective, we ensure that Safaricom is run in an ethical, transparent and accountable manner by having robust governance processes and structures in place, along with explicit guiding principles and clear lines of responsibility.

This minimises the risk of corruption and fraud, which, in turn, bolsters the reputation and trust we enjoy, strengthens employee morale and engagement, and improves stakeholder sentiment and interest. Unlawful or dishonest dealings will not only impact revenues negatively, and damage the brand and reputation of the company in the market, but are likely to result in legal charges, potential imprisonment, fines, a loss of investment and other unconstructive consequences.

Our response to governance is multi-dimensional and requires having the right structures in place and then monitoring and evaluating these regularly. The Board of Directors is, ultimately, responsible for corporate governance throughout the organisation and the behaviour of members is governed by an explicit Governance Charter. Members of the Board also undergo collective and individual performance assessments at least once annually.

The Board of Directors

The Board is closely involved in approving the strategic plans of the organisation, which include factors affecting sustainability. During the reporting period, the Board met twice to review strategy, and the CEO updates the Board on economic, social and environmental performance every quarter. The CEO is responsible for social, economic and environmental performance and is the sustainability champion on the Board.

The Safaricom Board consists of 9 members, 8 nonexecutive and one executive director. The Board undertakes conflict of interest declarations and any potential conflicts of interest are discussed during meetings of the Board; if applicable, these conflicts are disclosed appropriately. All employees at Safaricom also make declarations, in terms of employee relations and/ or business relations.

The Nomination and Remuneration Committee (REMCO) recommends and nominates individuals for Board interviews. Members of the committee consider specific skills (technical, telecommunications, financial and general management) and gender when assessing potential candidates. Shareholders also nominate people to the Board.

LOOKING AHEAD

From a regulatory perspective, we will continue to ensure compliance with the current laws and regulations affecting our business operating environment. We are proactively engaging with the Communications Authority of Kenya (CA) on three issues, in particular:

Information and Communications Sector Regulations

The CA has begun a comprehensive review of the regulations governing the sector and is proposing to impose retail price controls on perceived dominant operators. While we welcome attempts to grow the market and to provide consumers with the very best offerings in terms of variety, price and quality, we are concerned that the current proposals will unduly impact our ability to respond to market forces and to compete fairly.

National ICT Policy

In October 2014, the government published a draft ICT policy for stakeholder comments and input. We have made formal submissions in response regarding infrastructure sharing, the county telecommunications operators, the reduction of radio spectrum fees and the need to include incentives for environmental management.

From a risk management perspective, we plan to conduct two company-wide risk assessments and six fraud reviews during the year ahead and, in terms of ethics, we plan to ensure 97% of members of staff receive training, along with 80% of our dealers and our top 200 suppliers.

As a country, fraud and corruption remains a common practice. Being part of this ecosystem we remain susceptible to this vice and more concrete measures needs to be taken to fight and change this culture both internally and externally.