Safaricom Sustainability Report 2016

71

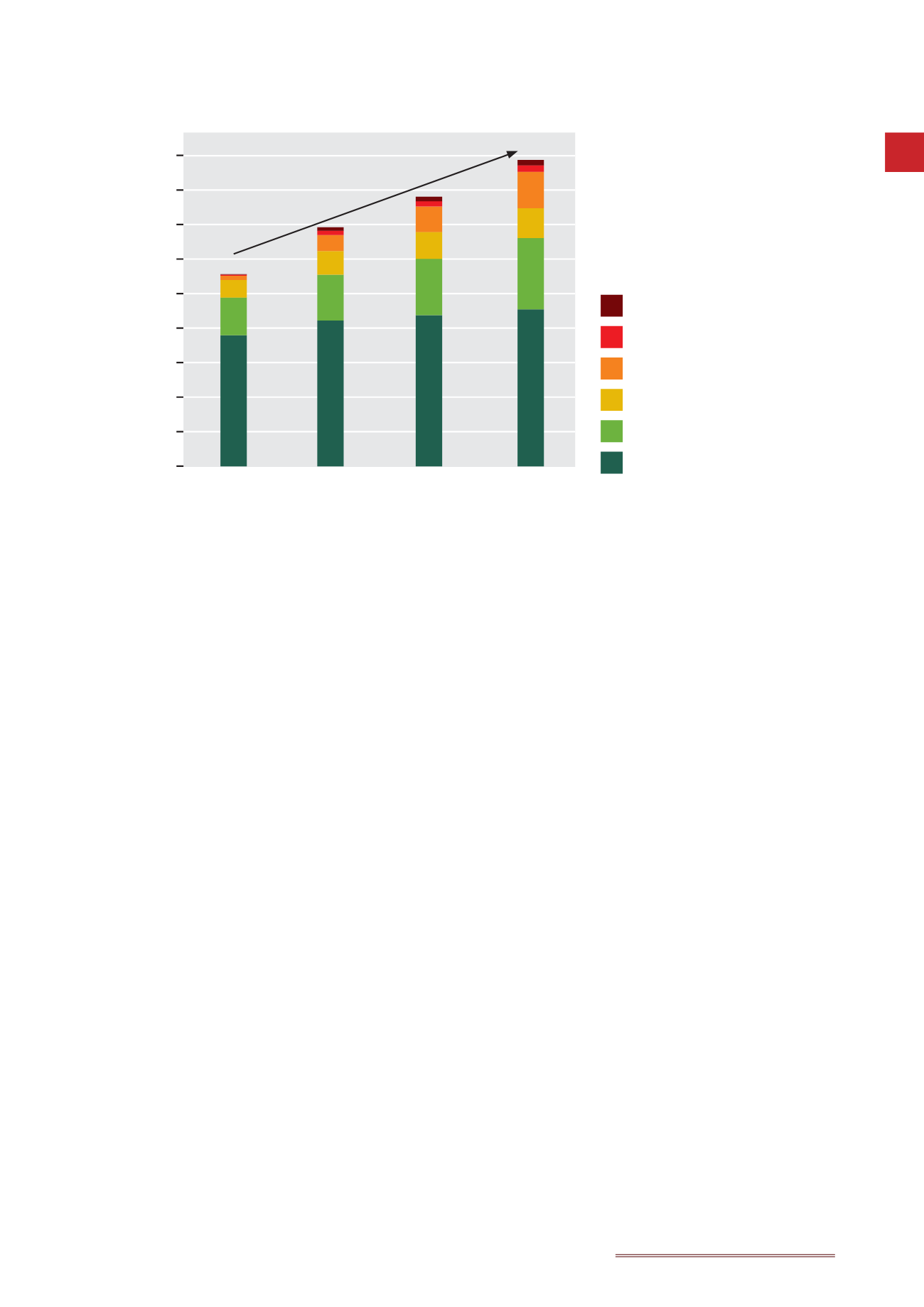

This strong financial performance is

the result of Safaricom successfully

implementing its strategy to grow

revenue while controlling costs (please

refer to the Annual Report for more

details).

31 Mar 2013

160,000

140,000

120,000

100,000

80,000

40,000

60,000

0

20,000

31 Mar 2014

FINANCIAL YEAR

KShs (MILLION)

31 Mar 2015 31 Mar 2016

180,000

Compound Annual Growth Rate (CAGR) 14.6%

Communications to investors:

We engage with individual investors, fund managers, analysts and other members of the investment community actively. On

a regular, ongoing basis, we deliver value to these important stakeholders by ensuring that we are available to them and

respond to their telephonic, email and message-based enquiries swiftly. We also publish an annual report to keep investors

updated on financial and non-financial performance, and we hold an annual general meeting, which provides a forum for

discussion and debate with shareholders.

We also disseminate information about financial results, reports and upcoming events to them via press releases and other

communiqués. In addition, we will invite shareholders and other members of the investment community to briefings and

workshops as required.

We maintain an up-to-date investor dashboard on the Safaricom website as well, which enables investors to access a wide

range of information conveniently and easily, including our investor calendar of events and forms, our current corporate

strategy, analyst coverage, fact sheets, share price information, half year and full year results, our reports, along with

information regarding our current governance and sustainability objectives and performance.

Along with these standard, ongoing responses, some of the specific ways in which we have delivered value to our

shareholders during the reporting period include:

•

Local and international investor road shows

During the year, we hosted investor road shows to share our interim and full year results. During these roadshows we

update shareholders on our strategy and outlook.

•

Swift dividend payouts

During the year, we continued to pay investors their dividends through our M-PESA platform, which makes it a cheaper

and more convenient process for recipients, particularly smaller investors.

•

Assistance with reclaiming lapsed dividends

We continue to address issues around unclaimed dividends as these arise, primarily, by advising the affected

shareholders on the process of claiming their dividends from the Unclaimed Financial Assets Authority (UFAA). We also

intend to encourage the UFAA to continue with initiatives of educating the shareholders on the implications of the

Unclaimed Financial Assets Act. This is in addition to informing our shareholders of the same and encouraging them to

encash any outstanding dividend cheques or opt to be paid by other faster means, such as M-PESA and EFTs.

Voice revenue

M-PESA revenue

Mobile data revenue

SMS revenue

Fixed service revenue

Other service revenue