![]() We consider our material matters to be those economic, governance, social and environmental issues that have the potential to impact the long-term sustainability of our business, and that may underlie certain risks, challenges and opportunities that we face. As such, determining, identifying and assessing these material matters forms an important part of our intellectual capital, and has a bearing on both the framing and the implementation of our strategy, and our relationships with our stakeholders.

We consider our material matters to be those economic, governance, social and environmental issues that have the potential to impact the long-term sustainability of our business, and that may underlie certain risks, challenges and opportunities that we face. As such, determining, identifying and assessing these material matters forms an important part of our intellectual capital, and has a bearing on both the framing and the implementation of our strategy, and our relationships with our stakeholders.

The management of risk and uncertainty is a fundamental component of our intellectual capital, and it plays an integral part in our successfully delivering on our strategic objectives.

Managing uncertainty in our business

We have embedded a robust risk management framework and practice as central to good management. This is confirmed by our top-down approach, with the Board taking overall responsibility for managing risk. With ongoing appropriate support provided for risk management, we drive a positive risk culture across the organisation.

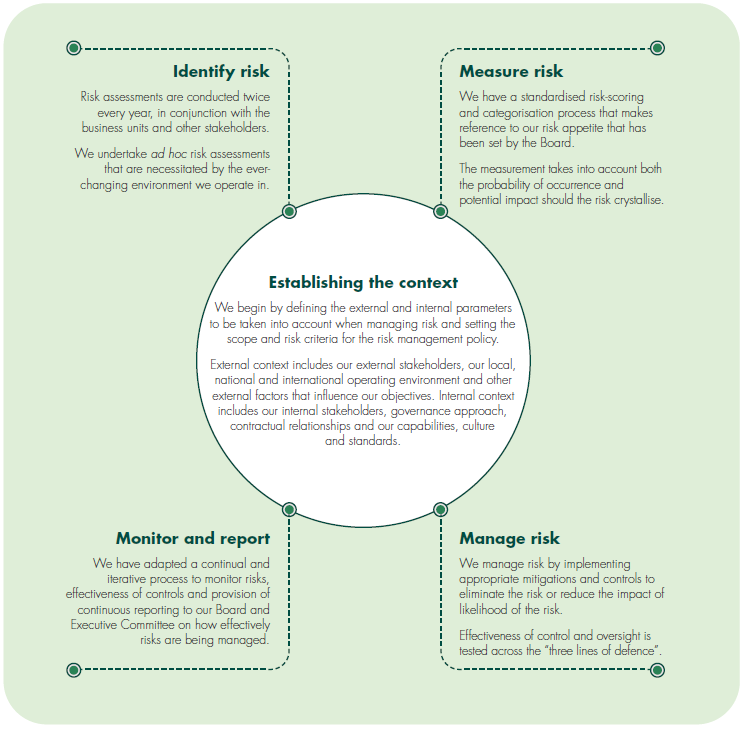

Our enterprise risk management framework (ERMF)

Our ERMF is aligned to the ISO 31000 Risk Management Standard. This allows us to identify, measure, manage and monitor strategic and operational risks across the business. The framework provides our management with a clear line of sight over risk, to enable informed decision-making. We continuously review our risk management framework to ensure that it continues to provide the foundation and organisational arrangements for identifying, treating, reporting, monitoring, reviewing and continually improving risk management throughout the organisation.

Our approach

We believe that effective risk management begins with conversations relevant and appropriate for the facilitation of better business decisions. Our focus is to identify and embed mitigation actions for material risks that could impact our current or future performance, and/or our reputation.

We regularly review and refresh our principal risks, our risk appetite and our approach to risk management, which is holistic and integrated and brings together risk management, internal controls and business integrity to ensure that our activities in this area focus on the risks that could have the greatest impact. Moreover, our approach is structured to ensure that all reasonable steps are taken to mitigate, but not to eliminate, our principal risks in this context.

Our risk appetite statement

The Group faces a broad range of risks while carrying out its business operations. We recognise that the existence of risk is an inherent part of creating and preserving value, and we have therefore developed detailed processes to ensure all critical and major risks are proactively managed, and that our levels of tolerance are properly and diligently set.

Our risk management philosophy

We recognise that it is not possible to eliminate all the risks inherent in our operations and that acceptance of some risks is necessary if we are to foster innovation, develop a sustainable business, and maximise value for shareholders. Our risk philosophy is aligned to best risk management practice and is aimed at supporting the attainment of our purpose, vision and mission by effectively balancing risk and reward.

Our principal risks and what we are doing about them

Our risk identification and mitigation processes have been designed to be responsive to the ever-changing environment in which we operate.

We identify our key risks through our ERMF, which provides the Executive Committee and Board with a robust assessment of the principal risks facing the Group. An embedded enterprise risk management process supports the identification of these principal risks. The risk appetite for each principal risk is reviewed and approved by the Board to enable informed risk-based decision-making.

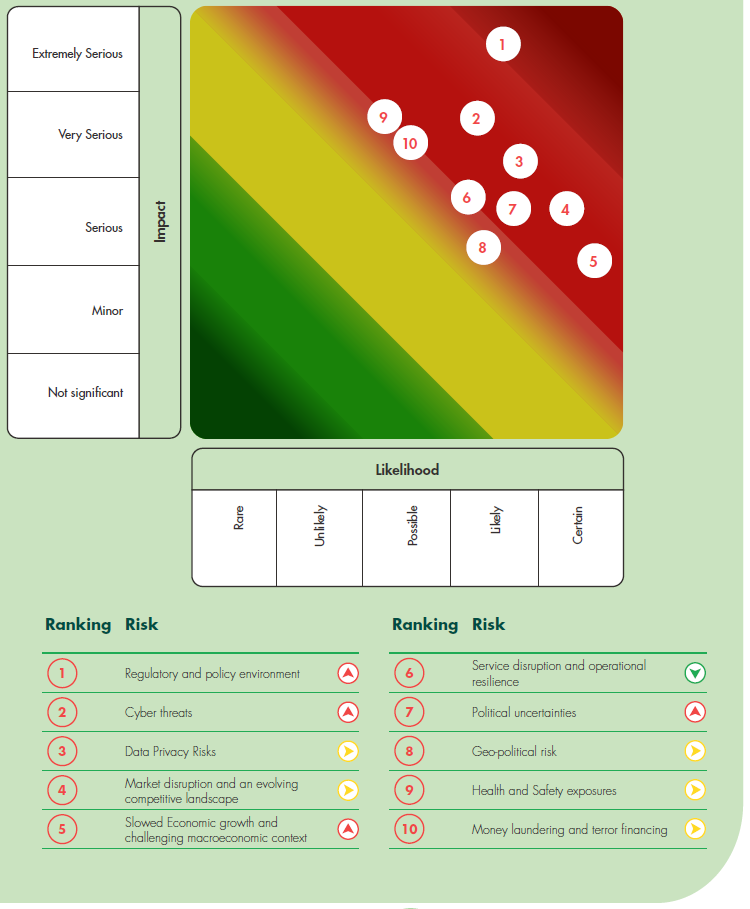

Our risk heat map sets out the principal risks as identified through the risk management process that covers strategy and operations. It depicts the residual risk rating after mitigating controls have been implemented.

Residual risk – after mitigations

![]() Our strategy forms a fundamental part of our intellectual capital, and it emphasises our purpose of Transforming Lives. With feedback from our customers and our recognition of the centrality of our purpose as a socially responsible organisation, our strategy is designed to decisively support what our customers need to transform their lives through technology.

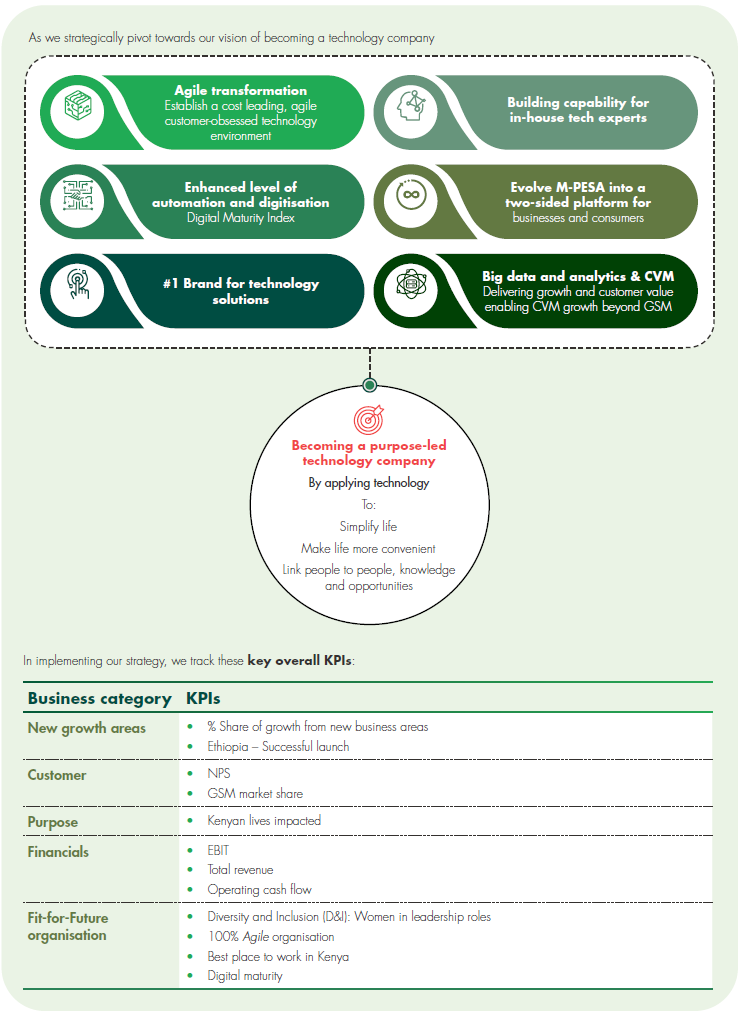

Our strategy forms a fundamental part of our intellectual capital, and it emphasises our purpose of Transforming Lives. With feedback from our customers and our recognition of the centrality of our purpose as a socially responsible organisation, our strategy is designed to decisively support what our customers need to transform their lives through technology.

The overall strategic goal of our new five-year strategy, approved by the Board in FY2020, is for the Group to be a purpose-led technology company by the end of 2025.

Click here to open Our strategic framework

![]()

![]() Our value-creating business model forms a fundamental part of our financial and intellectual capital. It frames the way we create value for all our stakeholders, and is the foundation of our growth through sustained investment centred on customer experience.

Our value-creating business model forms a fundamental part of our financial and intellectual capital. It frames the way we create value for all our stakeholders, and is the foundation of our growth through sustained investment centred on customer experience.

![]() Our engagement with, and management of, our stakeholders form a key part of our social and relationship capital. Our recognition of their concerns and the insights we derive from the feedback we receive from them regarding our activities, enable us to devise our strategy, shape our approach to sustainability, and ultimately to create and deliver value and achieve success.

Our engagement with, and management of, our stakeholders form a key part of our social and relationship capital. Our recognition of their concerns and the insights we derive from the feedback we receive from them regarding our activities, enable us to devise our strategy, shape our approach to sustainability, and ultimately to create and deliver value and achieve success.

During the year under review, we continued in our commitment to engage with all our stakeholders, to what material interests are involved, and to address mutual concerns through meaningful channels of engagement.