Our corporate governance statement

Safaricom PLC, through its Board of Directors is committed to implementing and adhering to good corporate governance and best practice.

The Company has instituted systems to ensure that high standards of corporate governance are maintained at all levels of the Company. Safaricom continues to endeavour to comply with the provisions of the Capital Markets Authority (CMA) Code of Corporate Governance Practices for Issuers of Securities to the Public 2015 (the Code).

Over and above the annual self-assessment that the Company is expected to complete on its level of compliance of the Code, the Corporate Governance Statement as provided in this Annual Report will highlight to the Company’s shareholders and various stakeholders, the performance to date. We remain committed to the highest standards of corporate governance and business ethics. Good corporate governance practices are essential to the delivery of long term and sustainable stakeholder and shareholder value.

The Company also adheres to other regulations promulgated by the CMA and the Nairobi Securities Exchange and the ethical standards prescribed in the Company Code of Conduct. In addition, Safaricom abides by the tenets of the Constitution of Kenya and all other laws as a law-abiding corporate citizen.

We continuously assess our governance operating model to ensure that robust internal governing bodies and proper systems/processes are in place to support the Board and Management to drive change, set strategic direction and formulate high-level goals and policies.

The Board of Directors of Safaricom is responsible for the governance of the Company. The Directors are committed to fulfilling their fiduciary responsibilities and have instituted various principles necessary to ensure that good governance is practiced with respect to dealings with the Company’s shareholders, customers and other relevant stakeholders in line with the spirit of the Code of Corporate Governance for listed Companies.

The Board is committed to ensuring that a strong governance framework operates throughout the Company, recognising that good corporate governance is a vital component to support management in their delivery of the Company’s strategic objectives, and to operate a sustainable business for the benefit of all stakeholders. The Board recognises that the process of identifying, developing and maintaining high standards of corporate governance suitable for the Company is ongoing and dynamic to reflect changes in the Company and its business, the composition of the Board and developments in corporate governance.

The role of the Board

The Board is collectively accountable and responsible for the Company’s vision, strategic direction, its values, and governance. The responsibility for implementing strategy and day-to-day operations has been delegated by the Board to the Chief Executive Officer (CEO) and his Senior Leadership Team.

The primary role of the Board remains the provision of effective leadership to the Company towards:

- sustainable long-term success through the exercise of objective and informed judgement in determining the strategy of the Company;

- having the right team in place to execute the strategy through effective succession planning;

- setting up appropriate governance structures for the management of the business operations;

- monitoring business performance and maintaining an effective framework of controls to mitigate risks facing the business; and

- ensuring ethical behaviour and compliance with the laws and regulations.

The Board is solely responsible for its agenda. It is, however, the responsibility of the Chairman and the Company Secretary, working closely with the Chief Executive Officer, to come up with the annual Board work plan and the agenda for the Board meetings. The Board work plan for FY2022/2023 was approved by the Board at its meeting held on 28 October 2021.

Key responsibilities of the Board include:

- Provide effective leadership in collaboration with the Executive management team;

- Approve the Company’s mission, vision, its business strategy, goals, risk policy plans and objectives;

- Approving the Company’s business strategy and ensure the necessary financial and human resources are in place to meet agreed objectives;

- Approve the Company’s budgets as proposed by the Executive management team;

- Establish and agree an appropriate governance framework;

- Review the sufficiency, effectiveness and integrity of the risk management and internal control systems;

- Approve the Company’s performance objectives and monitoring their achievement;

- Review and agree Board succession plans and approve Non-Executive Director appointments;

- Review periodic financial and governance reports;

- Approve the Annual Report, Company results and public announcements;

- Declaring an interim/recommending a final dividend;

- Approving Company Policies and monitoring compliance with the Standards of Business Conduct; and

- Ensuring that the relevant audits, e.g. financial, governance or legal and compliance are conducted.

The Board has established two principal Board Committees, to which it has delegated certain responsibilities, namely: the Audit, Risk and Compliance Committee and the Nominations and Remuneration Committee. The roles, membership and activities of these Committees are described in more detail later in this Report. Each Committee has its own terms of reference which are reviewed periodically and updated as appropriate.

Board size, independence and appointments

The constitution of the Company’s Board is stipulated by the Company’s Articles of Association. It comprises of 11 Directors, 10 of whom are Non-Executive Directors and one is an Executive Director (the CEO). As at 11 May 2022 (being the date of approval of the Financial Statements for the year ended 31 March 2022), three of the Non-Executive Directors were Independent as defined in the Code.

In line with the Company’s Articles of Association, and their current shareholding, 3 out of the 10 Non-Executive Directors are appointed by the Government of Kenya and 4 out of the 10 Non-Executive Directors, are appointed by Vodafone Kenya Limited. The Non-Executive Directors, other than those appointed by Government of Kenya and Vodafone Kenya Limited, are subject to retirement by rotation and seek re-election (if they choose to) by shareholders in accordance with the Articles of Association.

Proposed candidates for the role of Independent Director, undergo a formal screening process conducted by the Nominations, Remuneration and Governance Committee of the Board before they are formally appointed. In between AGMs, in the event of any vacancy, the Board may appoint Directors to serve until the next AGM. Any such appointment of Independent Directors is brought to the attention of the shareholders through the notice of the AGM, and the Director, if they opt to seek re-election, is subjected to an election process by the shareholders, at the next AGM following their appointment.

Separation of powers and duties of the Chairman and the Chief Executive Officer

The Chairperson and the Chief Executive Officer (CEO) have distinct and clearly defined duties and responsibilities. The separation of the functions of the Chairman (a Non-Executive Director) and the CEO (Executive Director) supports and ensures the independence of the Board and Management. The balance of power, increased accountability, clear definition of responsibilities and improved decision-making are attained through a clear distinction between the non-executive and executive roles.

A summary of each role can be found below:

The Chairman

- Leads the Board, sets each meeting agenda and ensures the Board receives accurate, timely and clear information in order to monitor, challenge, guide and take sound decisions;

- Promotes a culture of open debate between the Non-Executive Directors and Executive Directors and holds meetings with the Non-Executive Directors, without the Executive Directors present;

- Regularly meets with the Chief Executive Officer and other Senior Management to stay informed;

- Ensures effective communication with shareholders and other stakeholders;

- Promotes high standards of corporate governance;

- Promotes and safeguards the interests and reputation of the Company; and

- Represents the Company to government, shareholders, regulators, financial institutions, the media, the community and the public.

The Chief Executive Officer

- Is responsible for the day-to-day management of the business of the Company and to oversee the implementation of strategy and policies approved by the Board and serving as the official spokesperson for the Company;

- Provides coherent leadership of the Company, including representing the Company to customers, suppliers, governments, shareholders, financial institutions, employees, the media, the community and the public and enhances the Company’s reputation;

- Leads the Executive Directors and senior management team in running the Company’s business, including chairing the Executive Committee;

- Develops and implements the Company’s objectives in line with the strategy having regard to shareholders and other stakeholders;

- Manages the Company’s risk profile and ensures appropriate internal controls are in place;

- Ensures compliance with legal, regulatory, corporate governance, social, ethical and environmental requirements and best practice; and

- Ensures that there are effective processes for engaging with, communicating with, and listening to, employees and others working for the Company.

The role of the Non-Executive Directors

The Board had 10 Non-Executive Directors as at 31 March 2022 and as at the date of this Annual Report.

The Non-Executive Directors come from broad industry and professional backgrounds, with varied experience and expertise aligned to the needs of the business.

The Non-Executive Directors help develop strategy and are responsible for ensuring that the business strategies proposed are fully discussed and critically reviewed. This enables the Directors to promote the success of the Company for the benefit of its shareholders, with consideration of, among other matters, the interests of employees, the fostering of business relationships with customers, suppliers and other stakeholders. The Non-Executive Directors oversee the operational performance of the business, scrutinise performance of Management and the Company, bring an external perspective to the Board, monitor reporting of performance and should be available to meet with major stakeholders as appropriate. To perform these tasks, they have access to relevant information, with updates provided on regulatory and other matters affecting the Company.

The Company Secretary

The Company Secretary is a member in good standing with the Institute of Certified Secretaries (ICS). The Company Secretary provides a central source of guidance and advice to the Board on matters of governance, statutory compliance and compliance with the regulators.

The role of the Company Secretary

- Providing a central source of guidance and advice to the Board, and the Company, on matters of statutory and regulatory compliance and good governance;

- Providing the Board and the Directors individually with guidance on how their responsibilities should be discharged in the best interests of the Company;

- Facilitating the induction training of new Directors and assisting with the Directors’ professional development as required. This includes identifying and facilitating continuous Board education;

- In consultation with the CEO and the Chairman, ensuring effective flow of information within the Board and its committees and between senior management and Non-Executive Directors. This includes timely compilation and distribution of Board papers and minutes, as well as communication of resolutions from Board meetings;

- Guiding the Company in taking the initiative to not only disclose corporate governance matters as required by law, but also information of material importance to decision-making by shareholders, customers and other stakeholders;

- Coordinating the governance audit process;

- Assisting the Board with the evaluation exercise; and

- Keeping formal records of Board discussions and following up on the timely execution of agreed actions.

Board operations

The Safaricom Board meets at least four times a year and the meetings are structured in a way that allows for open discussions.

Comprehensive Board papers are prepared and circulated to all Directors for all substantive agenda items prior to the meeting. This allows time for the Directors to undertake an appropriate review of the Board papers to facilitate full and effective discussions at the meetings. The submissions and notification period may be waived should any urgent and critical matters arise within the two-week period to the date of the meeting.

Where Directors are unable to attend a meeting, they are advised on the matters to be discussed and given the opportunity to make their views known to the Chairman or the Chief Executive Officer prior to the meeting.

The members of the Senior Leadership Team may be invited to attend the Board and/or Committee meetings if deemed necessary and as appropriate, to make presentations on their areas of responsibility. This serves as an opportunity to give the Directors greater insights into their business areas. Non-Executive Directors are also occasionally invited to attend the senior leadership’s strategic and operations review meetings to gain further insights into different aspects of the business.

The composition of the Board

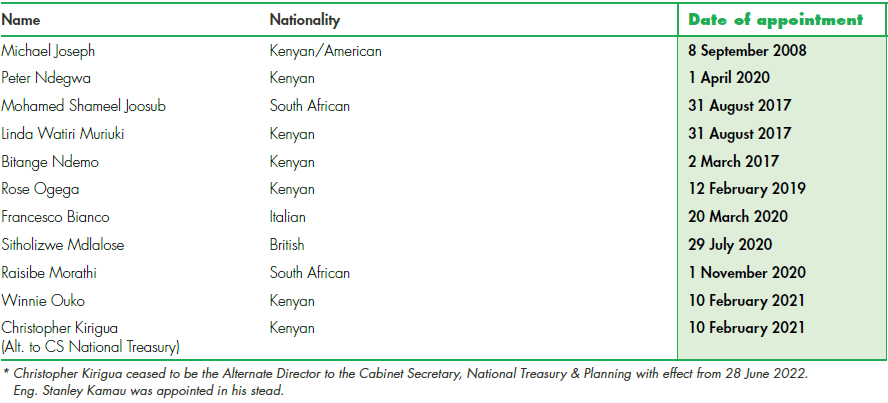

The Directors who served during the year to 31 March 2022 are set out below:

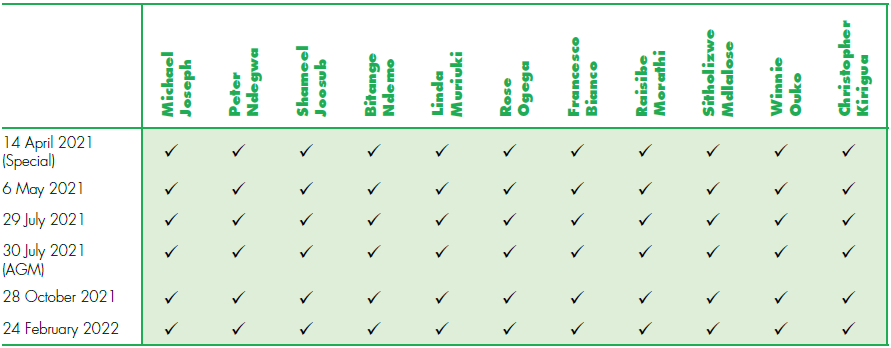

A summary of Board meetings and attendance in the year under review is indicated below:

Board meetings and Annual General Meeting attendance from 1 April 2021 to 31 March 2022

Board effectiveness

The effectiveness of the Board in its oversight and leadership role is enhanced by a robust support system. This is facilitated through the following:

Board diversity

The Board recognises and embraces the benefits of diversity and views increasing diversity as an essential element in maintaining a competitive advantage. The Board also recognises the role of diversity in bringing different perspectives into Board debates, and offers better anticipation of the risks that are inherent in the business and the opportunities that the business pursues. The Non-Executive Directors come from broad industry and professional backgrounds, with varied experience and expertise aligned to the needs of the business. The areas of expertise of the current Board of Directors include: business management, telecommunications, banking and finance, electrical engineering, IT, mobile money, corporate communications, economics, marketing, project management, risk management, human resources, legal and governance.

Balance of Non-Executive Directors and Executive Directors:

Non-Executive Directors comprise 91% Executive Directors comprise 9%.

Length of tenure:

Less than 1 year – 1; 1 to 3 years – 6 Directors; 4 to 6 years – 3 Directors; 7 to >9 years – 1 Director

Gender split of Directors:

Male 64%; Female 36%

Independence

As at the date of this Annual Report, three (3) of the Non-Executive Directors were Independent as defined by the Code; the Company has committed to commence the process of appointment of a fourth Independent Directors so that a third of the Board comprises of Independent Directors.

Management of conflicts of interest

The Directors are obligated to fully disclose to the Board any real or potential conflict of interest, which comes to any Director’s attention, whether direct or indirect. The statutory duty to avoid situations in which the Directors have or may have interests that conflict with those of the Company has been observed by the Board in the financial year under review. All business transactions with all parties, Directors or their related parties are carried out at arm’s-length. An acknowledgement that should it come to the attention of a Director that a matter concerning the Company may result in a conflict of interest, obligates the Director to declare the same and exclude himself/herself from any discussion or decision over the matter in question.

The Board has formal procedures for managing conflicts of interest in accordance with the Companies Act 2015 and the CMA Code of Corporate Governance Practices for Issuers of Securities to the Public. Directors are required to give advance notice of any conflict issues to the Chairman or Company Secretary, and these are considered at the next Board meeting.

Declaration of conflicts of interest is also a standard agenda item which is addressed at the onset of each Board and Committee meeting. Directors who are conflicted, are excluded from the quorum and vote, in respect of any matters in which they have an interest. Conflicts on related party transactions were reported by Directors in the year under review.

Director induction

On joining the Board, all new Directors receive a detailed induction. This provides an overview of the Company, the Company’s operating environment and new developments thereof, accounting and financial reporting developments, as well as any regulatory changes. As part of the induction training, detailed presentations by management, are factored in, so that the Directors gain a good sense of the Company’s operations and central functions. The induction process of a new Director is initiated by the Chairman of the Board and is progressed by the Chief Executive Officer, members of the Senior Leadership Team and the Company Secretary.

Training and development

Board members undergo regular training and education to enable them to fulfil their responsibilities. Directors receive functional presentations built into the annual Board Work Plan to gain a good sense of the Company’s operations and central functions. The Board and its Committees receive briefings and participates in deep dive sessions on various matters such as risks and their mitigations, legal and regulatory developments that directly impact the operations of the Company.

During the financial year under review, the Directors engaged in facilitator-led training from credible sources on areas of Governance. Topics discussed included: Data Protection and Privacy matters and Cybersecurity and Anti-money laundering and Counter Finance Terrorism. To better understand the business, in the period under review, the Board also held deep dive sessions on Data Privacy, the Network and IT and on Mobile Termination Rates. The main Strategy session was held in April 2022.

Access to Independent Advice

The Board recognises that there may be occasions when one or more Directors considers it necessary to take Independent Advice on various matters such as legal or financial advice, at the Company’s expense. This is provided for in the Board Charter and the Terms of Reference of each Committee.

Governance Audit

In compliance with the CMA Code of Corporate Governance Practices for Issuers of Securities to the Public, 2015, the Board appointed Ms. Catherine Musakali of Dorion Associates LLP to conduct the Company’s Governance Audit. The Governance Audit Report was adopted by the Board of Directors on 28 October 2021. In the opinion of the Governance Auditor, the Board has put in place a governance framework that is broadly in compliance with the legal and regulatory corporate governance requirements. The Company was issued with an unqualified opinion.

Legal and Compliance Audit

In compliance with the CMA Code of Corporate Governance Practices for Issuers of Securities to the Public, 2015, an internal Legal and Compliance Audit was carried out for the year ended 31 March 2022 with the objective of ascertaining the level of adherence to applicable laws, regulations and standards in order to deliver long-term value to stakeholders. The findings from the audit confirmed that the Company was generally in compliance with applicable laws and regulations. Implementation of the recommendations from the external Legal and Compliance Audit conducted in 2021 are ongoing.

Key deliberations by the Board

During the year under review, the key areas of focus for the Board’s activities and topics discussed during the year were on the following matters:

- Approved the strategy and reviewed its implementation on a quarterly basis including ensuring necessary financial and human resources are in place to meet agreed objectives.

- Managing the challenges presented by COVID-19 was a key focus area for the Board. Key for the Board was protecting its people and sustaining the business and having in place a safe return to work protocol for employees.

- Approved the set-up of the entity in Ethiopia and discussed amongst other matters the funding and launch of the business in the market; the political and security risk in Ethiopia and mitigations thereof.

- Approved the FY2021/2022 budget.

- Monitored performance against the approved budget of the Company.

- Approved the half year results as well as the end of year results, press release and commentary.

- Approved the interim dividend for the year ended 31 March 2022 and made a recommendation to the shareholders on the approval of the final dividend.

- Approved the Audit fees for the external auditor.

- Approved the revised remuneration for the Non-Executive Directors.

- Monitored the political and regulatory trends and developments and their implications for the business.

- Discussed the role of the Company in the forthcoming General Elections and the Continuity and Resiliency Plan pre- and post- the General Elections.

- Discussed and improved the Board’s understanding of key risks facing the Company.

- Discussed the risks and mitigations thereof that the business was exposed to including cyber threats, changing regulations.

- Approved the employee compensation, bonus and share grants.

- Discussed the governance audit and implementation of the recommendations thereof.

- Reviewed and monitored the significant litigation cases and their liability.

- Received regular reports of the proceedings of the Audit, Risk and Compliance Committee, the Nominations, Remuneration and Governance Committee and the Investment Committee.

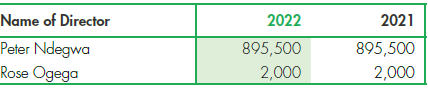

Directors’ shareholding

Directors can purchase or sell shares of the Company in the open market. None of the Directors as at the end of financial year under review held shares in their individual capacity of more than 1% of the Company’s total equity.

The breakdown of the Directors’ personal shareholding in the Company as at 31 March 2022 is as follows:

Board committees

The Board has two standing committees: an Audit, Risk and Compliance Committee and a Nominations, Remuneration and Governance Committee. Each committee has formal and approved terms of reference. The Board periodically reviews the terms of reference for each of these committees to ensure they are in line with current legislation and best practice. The committees are provided with all necessary resources to enable them to undertake their duties effectively.

Audit, Risk and Compliance Committee

Membership

The Audit, Risk and Compliance Committee consists of six Non-Executive Directors and reports to the Board after every committee meeting. In line with the Code of Corporate Governance for Issuers of Securities to the Public 2015, the committee is comprised of at least three Independent and Non-Executive Directors. It is chaired by an Independent Non-Executive Director with at least one committee member holding a professional qualification in audit or accounting and in good standing with a relevant professional body.

Current members:

Rose Ogega – Chairperson

Bitange Ndemo

Winnie Ouko

Christopher Kirigua

Raisibe Morathi

Sitholizwe Mdlalose

Kathryne Maundu – Secretary of the Committee

Permanent invitees:

Peter Ndegwa – Chief Executive Officer

Dilip Pal – Chief Financial Officer

Nicholas Mulila – Chief Corporate Security Officer

Denish Osodo – Director, Internal Audit

Ernst & Young – External Auditor

Functions of the Audit, Risk and Compliance Committee

The Audit, Risk and Compliance Committee meets at least four times a year to discuss audit matters and four times to discuss risk matters. To fulfill its oversight responsibility, the committee receives reports from Management, the internal auditor and external auditors, as appropriate.

The responsibilities and role of the Audit, Risk and Compliance Committee includes:

- Monitor the integrity of the financial statements, including the review of significant financial reporting judgements;

- Provide advice to the Board on whether the Annual Report is fair, balanced and understandable and the appropriateness of the long-term viability statement;

- Review and monitor the external auditor’s independence and objectivity and the effectiveness of the external audit;

- Review the system of internal financial control and compliance;

- Monitor the activities and review the effectiveness of the Internal Audit function; and

- Monitor the Company’s risk management system, review of the principal risks and the management of those risks.

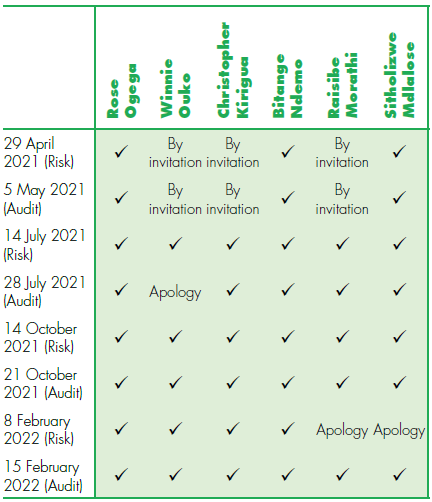

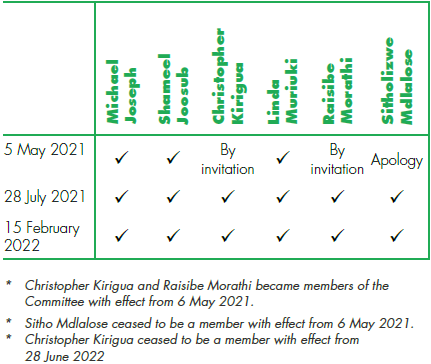

A summary of the attendance at meetings of the members of the Audit, Risk and Compliance Committee is shown below:

The attendance of the Board Audit, Risk and Compliance Committee Meetings for 2021/2022

Key Audit, Risk and Compliance Committee activities

During the financial year, the Committee substantively discussed the following matters:

- Reviewed the half year results and audited accounts and related reports

- Reviewed the interim and final dividend recommendations

- Reviewed the External Auditors’ Management Letter

- Discussed the External Audit Service Plan for the year ending 31 March 2022

- Reviewed the Internal Audit plan for the year ending 31 March 2023

- Reviewed the Internal Audit Reports in every quarter

- Reviewed the provisions of the Internal Audit Charter

- Reviewed the Terms of Reference of the Committee

- Reviewed the Committee’s work plan

- Reviewed the content of various policy documents

- Discussed in detail the Business Risk Updates including changes in the heat map; Cyber Security Management Updates,

AML/CFT Program Updates and Business Ethics and Compliance Updates - Discussed the risk status of Safaricom’s subsidiaries

- Significant litigations cases and liability thereof

- Annual review of the external auditor’s effectiveness and independence

- In camera sessions were held with the External and Internal Auditors

Financial and business reporting

The Board is satisfied that it has met its obligation to present a balanced and understandable assessment of the Company’s position throughout the Annual Report. It is appropriate to treat this business as a going concern as there is sufficient existing financing available to meet expected requirements in the foreseeable future.

The committee is assigned to review financial, audit and internal control issues in supporting the Board of Directors which is responsible for the Financial Statements and all information in the Annual Report.

Risk management and internal control

The Board is responsible for maintaining sound risk management and internal control systems and determining the nature and extent of the risks that the Company is willing to take to achieve its strategic objectives. With the support of the Audit, Risk and Compliance Committee, the Board carries out a regular review of the effectiveness of its risk management framework and internal control systems, covering all material controls including financial, operational and compliance controls.

Risk registers, based on a standardised methodology, are used to identify, assess and monitor the key risks (both financial and non-financial) faced by the business. Information on prevailing trends, for example whether a risk is increasing or decreasing over time, is provided in relation to each risk and all identified risks are assessed at five levels (extremely serious/very serious/serious/minor/not significant) by reference to their impact and likelihood. Mitigation plans are put in place to manage the risks identified and the risk registers are reviewed on a regular basis.

The Board, with advice from its Audit, Risk and Compliance Committee, has completed its annual review of the effectiveness of the risk management framework and internal controls for the year under review. No significant failings or weaknesses were identified, and the Board is satisfied that, where specific areas for improvement have been identified, processes are in place to ensure that the necessary remedial action is taken and that progress is monitored.

External Auditor

Messrs. Ernst & Young are the Company’s external auditor. The Audit, Risk and Compliance Committee considers that its relationship with the auditor worked well during the period and was satisfied with their effectiveness. The external auditor is required to rotate the audit partner responsible for the Company’s audit at least every five years. The current lead audit partner has been in position since 31 July 2020.

Nominations, Remuneration and Governance Committee

Membership

The Nominations, Remuneration and Governance Committee consists of five Non-Executive Directors and reports to the Board after every committee meeting. The current Chairperson is an Independent Non-Executive Director.

Current members:

Winnie Ouko – Chairperson

Michael Joseph

Linda Muriuki

Francesco Bianco

Christopher Kirigua

Kathryne Maundu – Secretary of the Committee

Permanent invitees:

Peter Ndegwa – Chief Executive Officer

Paul Kasimu – Chief Human Resources Officer

Functions of the Nominations, Remuneration and Governance Committee

The Nominations, Remuneration and Governance Committee meets at least four times a year. The purpose of the committee is to assist the Board:

- To review the balance and effectiveness of the Board and remuneration of Directors and senior management as well as the succession planning at Board and senior leadership levels;

- Monitoring the size and composition of the Board and its succession plans;

- Recommending individuals for nominations as members of the Board and its committees; and

- Reviewing executive appointments, succession and development plans and proposing the remuneration structures of executive and non-executive members of the Board.

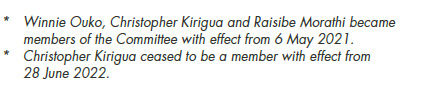

A summary of the Nominations, Remuneration and Governance Committee meeting members attendance is shown below:

The attendance of the Nominations, Remuneration and Governance Committee meetings for 2021/2022

Key discussions by the Nominations, Remuneration and Governance Committee

During the financial year, the Committee substantively discussed the following matters:

- Discussed the review and implementation of the overall organisation structure

- Reviewed the results of the annual employee opinion survey

- Reviewed the Non-Executive Directors’ Remuneration

- Reviewed the performance of the Chief Executive Officer

- Discussed the Performance Appraisal Framework for Senior Leadership Team

- Employee Compensation and Bonus Review for the year 2021/2022

- Discussed and approved the Share Grants Proposal for the year 2021/2022

- Reviewed the proposal on remuneration for Directors in the subsidiaries who are not employees of Safaricom PLC

- Reviewed the succession planning for the Senior Leadership Team

- Update on the status of implementation of the Board Evaluation Report

- Reviewed the Terms of Reference of the Committee

- Reviewed the Committee’s work plan

- Undertook an evaluation of the independence of the

Independent Directors - Reviewed and made recommendation to the Board on the composition of the Board Committees

- Discussed various HR thematic areas including: Culture, Organisation effectiveness, Talent and Diversity

Special committees

The Board is authorised by the Company’s Articles of Association to form ad hoc or special committees to deal with specific matters for a defined term period. The Board retains oversight authority over such committees.

The Board Investment Committee which handles key projects for the Company and the Ethics Committee, which plays an oversight role on behalf of the Board with regard to matters of ethics, integrity and best business practices.

A summary of the attendance at meetings of the members of the Board Investment Committee is shown below:

Besides complying with the Code and the laws, the Company has committed to embed internal rules of engagement to support corporate governance. These internal guidelines are constituted in various policies and in the Code of Business Conduct to which every employee, supplier and the Board makes a commitment to comply with.

Board Charter

The Board Charter is critical to Safaricom’s governance framework, and offers guidance on matters including but not limited to the following:

- The separation of the roles, functions, responsibilities and powers of the Board and its individual members;

- Powers delegated to the Board committees;

- Matters reserved for final decision-making and approval by the Board;

- Policies and practices of the Board on matters of corporate governance, Directors’ declarations and conflict of interest, conduct of Board and Board committee meetings; and

- Nomination, appointment, induction, ongoing training and performance evaluation of the Board and its committees.

The Charter is not a substitute or a replacement of any laws and regulations that govern the running of the Company.

The Board Charter is periodically reviewed to ensure that it remains current.

Code of Ethics and Conduct

The Company pursues ethical decision-making and leadership to promote corporate social responsibility, fair business practices, sustainability and the triple bottom line that focuses on the society, the environment and profitability. The Board has implemented a Code of Ethics and Conduct which binds Directors and employees and is subscribed to by all members of the Company. Initiatives to ensure its application include training, monitoring, mechanisms for whistle blowing, taking disciplinary action, etc. The Code has been integrated into the Company’s operations through the development of various policies and reporting mechanisms.

Safaricom Directors and employees are expected to act with honesty, integrity and fairness in all their dealings with one another and with stakeholders. When joining Safaricom, every employee is provided with a copy of the Code and must commit to abide by its requirements as part of the employment contract with the Company.

Board policies

The Board has established policy and procedure documents to guide the Directors and Management in the implementation of their roles and responsibilities. A brief summary of the governance documents and their key provisions are listed below:

Board remuneration policy

The policy sets out guidelines and criteria for the compensation of the Non-Executive Directors. The remuneration to be paid to the NEDs is guided by the findings of a survey conducted by an Independent Consultant and which is compared against the remuneration of a comparator organisations in the market. The findings of the survey are tabled and discussed in detail by the Board Nominations and Remuneration Committee. In order to ensure that the Company remunerated its Non-Executive Directors at the desired position to pay at least at the 75th percentile of the market.

Whistle blowing policy

We have a whistle blowing policy that provides for an ethics hotline managed by an Independent, Accredited and external institution. Through the hotline, anonymous reports on unethical/fraudulent behaviour can be made without fear of retaliation from the suspected individuals.

Whistle blowing statistics are reported to the Ethics Committee and the Audit Committee on a quarterly basis. Staff members and business partners are also regularly sensitised on the need to report any suspected unethical business practices.

The whistle blowing policy provides a platform for employees, suppliers, dealers and agents to raise concerns regarding any suspected wrongdoing, and the policy details how such concerns are addressed. The Board ensures that risks arising from any ethical issues are identified and managed in the risk management process.

The whistle blowing policy has been uploaded on the Company’s website.

Conflict of interest policy

Directors are obligated to fully disclose to the Board any real or potential conflict of interest which come to their attention, whether direct or indirect. All business transactions with all parties, Directors or their related parties are carried out at arm’s-length.

Operational policies

There are broad operation policies that guide Management in execution of the Company’s operations in an efficient and socially responsible manner. The policies cover various operational functions including: Human Resource, ICT, Risk Management, Financial Management, Sustainability, Environment, Safety and Health and Corporate Affairs.

Corporate social responsibility

Safaricom recognises that Corporate Social Investment (CSI) issues are of increasing importance to its stakeholders and are fundamental to the continued success of the business. Thus, we have a CSI policy that ensures we operate our business in a responsible manner at all times for the benefit of our customers, staff, suppliers, and the wider community. We exercise CSI by partnering with and investing in communities to find sustainable solutions. We also encourage our employees to take part in CSI initiatives aimed at improving the standards of living of the communities that they come from. Our CSI activities are disclosed every year in the social impact section of this report, sustainability and foundation reports.

Procurement policies

We have in place procurement policies that promote a fair and transparent procurement process, with emphasis on value for many and building mutually beneficial relationships with our suppliers. A Management Tender Committee oversees the award of tenders and there is appropriate risk assurance for procurement activities.

Insider trading policy

As a listed company, Safaricom is obliged under the Companies Act 2015 to require that the Directors and certain other employees with inside information do not abuse or place themselves under suspicion of abusing insider information that they may have or be thought to have.

This is especially so in periods leading up to an announcement of financial results. To this end, the Company has a policy on insider trading. Directors and staff are made aware that they ought not to trade in the Company’s shares while in possession of any material insider information that is not available to the public or during a closed period. To ensure compliance with the Companies Act, 2015 the Company communicates “open” and “closed” periods for trading in its shares to its employees and Directors on an annual basis. To the best of the Company’s knowledge, there was no insider dealing in the financial year under review.

Shareholder relations

We believe that good corporate governance is critical, not only at the corporate level but also at the national level. We require our partners to adhere to the highest level of integrity and business ethics in their dealings with us or with others.

In the financial year under review, we continued to achieve high levels of corporate governance by focusing on the following areas:

- Continuing to implement our strategy for the long-term prosperity of the business.

- Timely and relevant disclosures and financial reporting to our shareholders and other stakeholders for a clear understanding of our business operations and performance.

- Ensuring execution of strong audit procedures and audit independence.

- Strong internationally-recognised accounting principles.

- Focus on clearly defined Board and management duties and responsibilities.

- Focusing on compliance with relevant laws and upholding the highest levels of integrity in the Company’s culture and practice.

Relationship and communication with shareholders

Safaricom remains committed to relating openly with its shareholders by providing regular as well as ad hoc information on operating and financial performance and addressing any areas of concern. This is achieved through the following:

- Interim and Annual Results and publication of extracts of its financial performance in the daily newspapers, preparation of annual audited accounts and holding of the Annual General Meeting.

- Copies of the annual reports are made available to shareholders at least 21 days before the date of the AGM and they are free to raise questions to the Board during the meeting.

- The Company has a well-established culture on shareholder management which is handled by the Internal Investor Relations team, supported by the Company Secretary’s office and the Shares Registrars, Image Registrars Limited.

- The Safaricom website has a specific web page dedicated to the information requirements of the shareholders and investment analysts.

- Investor briefing sessions are held immediately after the announcement of interim and full year results.

- Local and international investor road shows are held after interim and full year results announcements; representatives of the Company’s senior leadership team in collaboration with known stock brokerage firms organise meetings with institutional investors, individual shareholder groups and financial analysts.

- The Board of Directors encourages shareholder participation at the Company’s annual shareholder meetings.

The Company’s AGM is an opportunity for shareholder engagement when the Chairman and the Chief Executive Officer explain the Company’s full-year performance and receive questions from shareholders.

The Chairpersons of the Audit, Risk and Compliance Committee and Nominations, Remuneration and Governance Committees are normally available at the AGM to take any relevant questions. All other Directors also attend, unless illness or pressing commitments preclude them from doing so.

During the investor briefings that were held in the year under review, shareholders and stakeholders were keen to hear more on the Company’s performance in light of COVID-19 pandemic, the Company’s Strategy in light of the COVID-19 pandemic, M-PESA free fees, the Company’s sustainability initiatives, capex guidance, regional expansion and the latest developments in industry regulation.

1.1 Introduction

The key objective of the Board Nominations, Remuneration and Governance Committee (BNRGC) is to make sure that the Board comprises of individuals with the necessary skills, knowledge and experience to ensure that it is effective in discharging its responsibilities and to review the remuneration of Directors and senior management as well as the succession planning at Board and senior leadership levels.

The members of the Committee during the year are indicated here. The Committee’s responsibilities have been set by the Board and are outlined in the Board Charter and the Terms of Reference of the Committee.

1.2 Directors’ Remuneration Report

1.2.1 Report preparation

The Directors’ Remuneration Report has been prepared to enlighten the shareholders on the remuneration payable to both the Executive and Non-Executive Directors. No changes have been made to the remuneration policy since its approval at the 2018 Annual General Meeting as it continued to support the strategy of the Company. It is the view of the Committee and the Board that the Company’s reward arrangements best support our business effectiveness by only delivering above target payouts when this is justified through Company performance and the current policy will support the implementation of the Company’s short-term and long-term objectives.

The Directors’ Remuneration Report is unaudited except where otherwise stated.

1.2.2 Regulatory compliance

In March 2016, the Capital Markets Authority (CMA) issued the Capital Markets Code for Issuers of Securities (The Code) which became operational 12 months after its gazettement. The Code outlines various compliance requirements with respect to the remuneration of Directors.

The Companies Act, 2015 which was enacted in September 2015 and became operational in June 2016, requires the Company to table a Directors’ Remuneration report to its shareholders as part of its audited financial statements. The Committee has prepared this report in accordance with the requirements of the Code and the Companies Act 2015 (the Act).

1.2.3 Current policy

The Company’s current remuneration policy reflects a commitment to the following principles:

a) ensuring our remuneration policy, and the manner in which it is implemented, drives the behaviours that support our strategy and business objectives;

b) maintaining a “pay for performance” approach to remuneration which ensures our incentive plans only deliver significant rewards if and when they are justified by business performance;

c) aligning the interests of our senior management team with those of shareholders by developing an approach to share ownership that helps to maintain commitment over the long-term; and

d) offering competitive and fair rates of pay and benefits.

1.2.4 Remuneration for Non-Executive Directors

The Company’s Non-Executive Directors’ (NEDs) are compensated in the form of fees but are not entitled to any pension, bonus or long-term incentives such as performance share plans. The package covers a Director’s role in the Board, any Board Committee(s) and any other activities as identified in the approved compensation schedule and in line with the Non-Executive Directors’ Remuneration policy. Elements of the compensation schedule include the following:

a) Annual retainer fee for the Chairman and other Non-Executive Directors, which is paid on a quarterly basis;

b) Sitting allowances for Board and Board Committee meetings;

c) Expenses incurred with respect to travel, accommodation, pre-approved consultancy fees or other expenses incurred as a result of carrying out duties as a Director are reimbursed at cost.

The Company’s policy is to remunerate its Non-Executive Directors at the desired position, to pay at least at the 75th percentile of the market. This ensures that the Company is competitive in sourcing and retaining its Directors.

The Non-Executive Directors’ remuneration was last reviewed in 2018 and had remained as is, leading to the pay being below the 75th percentile. Consequently, the current compensation structure was determined following a benchmarking exercise with comparable entities that was undertaken in 2021 by PricewaterhouseCoopers (PwC) and which was discussed substantively by the Nominations, Remuneration and Governance Committee in July 2021. The Board approved the revised compensation package for the Non-Executive Directors on 23 August 2021 and the revised pay took effect from 1 April 2021.

Details of the fees for the Non-Executive Directors and remuneration of the Executive Directors paid in the financial year under review are set out on the financial statements part of the annual report.

Going concern

The Board confirms that the financial statements are prepared on a going concern basis and is satisfied that the Company has adequate resources to continue in business for the foreseeable future. In making this assessment, the Directors consider a wide range of information relating to present and anticipated future conditions, including future projections of profitability, cash flows, capital and other resources.