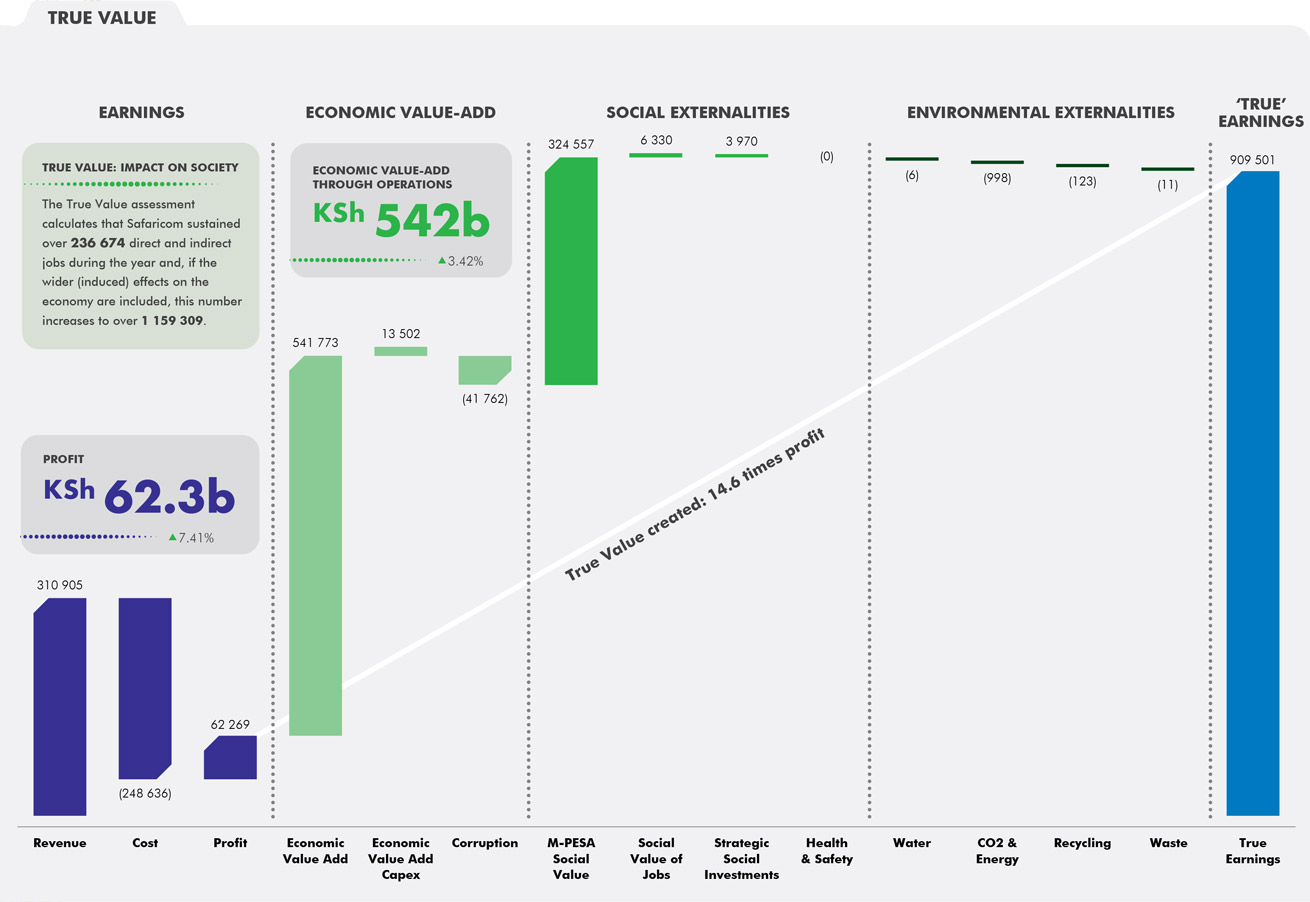

True Value: A three-step methodology that enables companies to (i) assess their ‘true’ earnings including externalities, (ii) understand future earnings at risk and (iii) develop business cases that create both corporate and societal value.

True Earnings: Monetization of the company’s externalities attributable to shareholders over and above profit. Total Economic Value: The nature and magnitude of the contribution Safaricom makes to the Kenyan economy. Direct Impact: Represents the additional gross value added to the Kenyan economy through our capital and operational expenditure capturing additional employment, income and trade.

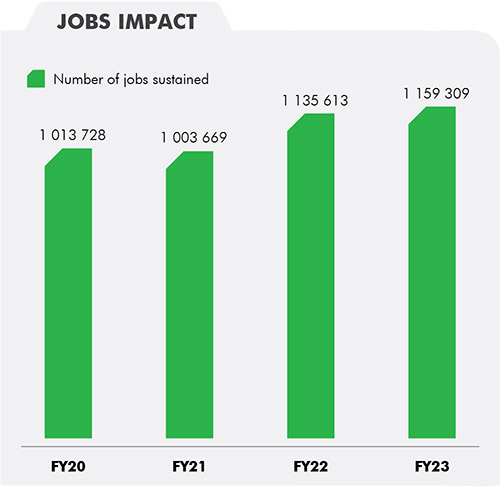

Indirect economic impact: Our direct expenditure also adds more widely to economic activity through the additional inputs purchased from suppliers. Initial demand for inputs results in heightened production and employment stimulating additional demand for goods and services along their own supply chains.

Induced economic impact: Our expenditure creates additional employment and benefits our suppliers’ employees. A proportion of the additional income generated in this way is spent on the consumption of goods and services. Through linkages and multiplier effects, this positively impacts the broader economy by stimulating additional demand for the products and services produced within the economy.